With an expectation that the gap is likely to increase further over the coming months, the leading pensions and financial services firm warns people against being tempted by scammers or otherwise to withdraw the cash in the face of financial hardships in the emerging COVID-19 economic downturn.

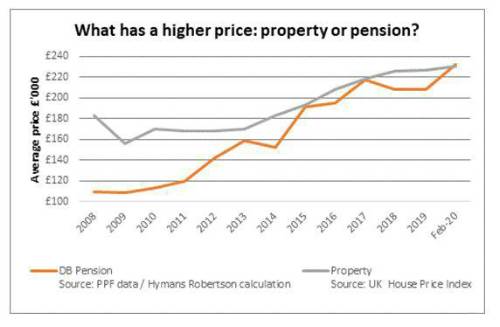

Commenting on the analysis and expectations for the post COVID -19 world, Calum Cooper, Partner, Hymans Robertson, says: “The latest ONS UK property price update, announced today, showed the average property value at the end of February 2020 had fallen again to now stand at £230,332. At the same time value of the average DB pension pot has continued to rise and now stands at £233,000. So much focus is put on property as an individual’s main asset so it may be a big surprise for those fortunate enough to have a DB pension that it is worth more. As this value was pre-lockdown, the discrepancy between the two values is likely to widen over the coming months too.

“Whilst there is much uncertainty, the weight of evidence points towards further falls in residential property values. Equities tend to lead the economic cycle while property often lags this so further declines in property prices could be expected. For pensions on the other hand, there is evidence that points to long term government bond yield declines following pandemics. That increases the value of lifetime incomes. That suggests that the higher value will not only be sustained but will rise, with some uncertainty. So, we could well see the difference in pension and property values widening with upper jaw of pensions pushing further upwards and lower jaw of property slipping.”

Warning against rushing to cash in pension, and the responsibility of schemes, Calum adds: “While this is great news for the 11 million fortunate to have a DB pension, it comes with a warning. Some people will inevitably become increasingly strapped for cash in this COVID-19 world of social and employment disruption. The longer the economic lockdown persists, the more likely it is that people will seek exceptional sources of cash to get by. Given the value of pensions and how much easier they are to access in a locked down world, than property, people could look to their them for cash. So, it is so important that this valuable asset is fully understood and not hastily cashed-in.

“Engagement, education and exploring all the options is key and stakeholders should be ensuring they provide information and support to help members make the best choices for them. We have found that 1 in 6 schemes have suspended DB transfers for three months which helps avoid rash decisions, but the need for cash is likely to continue for many more months. Trustees of DB schemes can be agile with their communications. It is vital to ensure members have a good understanding of their options and helping to facilitate financial advice would also provide a safe haven, reducing the risk of scams. Any dash for cash could lead to regret and heartache later. Pensions are so valuable right now for a reason. Lifetime financial certainty comes at a cost, and if you are fortunate to have it, think carefully about giving it all up.”

|