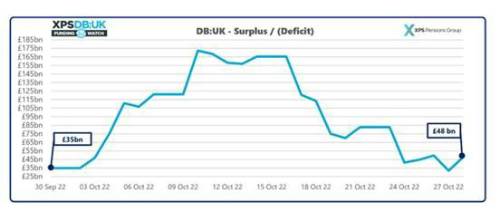

XPS Pensions Group estimates the aggregate funding level of UK pension schemes increased 1% to 103% during October, on a long-term target basis following a tumultuous month for gilt yields. UK pension schemes surpluses grew by £13bn during the month to 28 October 2022.

Despite the sharp mid-month spikes, gilt yields overall fell slightly from their position at the end of September although this was offset by long-term inflation expectations falling by 0.4% over the period, reducing the value of schemes’ liabilities.

UK pension schemes’ funding positions are likely to have increased by c.£13bn over the month to 28 October 2022 against long-term funding targets, an analysis from XPS’s DB:UK funding tracker has revealed. Based on assets of £1,504bn and liabilities of £1,456bn, the aggregate funding level of UK pension schemes on a long-term target basis was 103% as of 28 October 2022.

Drivers of the change

While a volatile month for gilt yields saw significant movements in funding levels, levels at the end of October finished similar to those estimated at the beginning of the month. Rises in gilt yields at the start of the month continued trends seen in September, however these were offset by falls later in the period as the UK Government reversed course on many of the economic policies that were poorly received by the market. Long-term inflation expectations continued to fall, dropping by 0.4% p.a. over the month, even as short-term inflation puts significant pressure on the cost of living.

Equity market assets (particularly in North America) had a positive month following a poor year to date, returning low single digits globally, which included the effect of Sterling appreciation which will have dampened local currency returns for UK pension schemes.

Projections difficult as schemes make difficult decisions

Huge increases in gilt yields in September saw LDI managers request additional collateral to rebalance their leveraged positions throughout the first half of October. As a result, some schemes will have been forced to choose between maintaining hedging levels or to retain the cash in growth assets. Whilst the actual aggregate level of hedges that have been reduced are not known, individual scheme decisions will have affected scheme funding towards the end of the month as yields fell significantly.

We estimate that for every 10% of hedging that was taken off at the peak on 11 October, a scheme’s funding level will be 2% worse than it would have otherwise been if the hedging level was not reduced. The decisions of individual schemes will only become clearer over time, and these decisions could have significant implications as the volatile year for investments continues.

Felix Currell, Senior Investment Consultant at XPS Pensions Group said: “It was a chaotic start to the month for pension schemes, with many of our clients concerned with the impact that LDI calls were having on their schemes and liquidity. Whilst a small minority of schemes will have been forced into choosing between maintaining hedging levels and targeting investment returns, XPS DB:UK reminds us that the improvements in funding positions over September have left many schemes in a fantastic position to achieve their long-term objectives.”

|