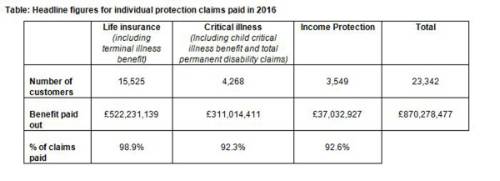

The insight* comes as the insurer releases its first Aviva Individual Protection Claims Report, which highlights that it paid out more than £870 million in claims last year, equating to £2.4 million every day. More than 23,000 Aviva UK customers and their families** benefitted from individual life, critical illness and income protection cover.

Aviva paid out 98.9% of life insurance claims to support families through a bereavement or terminal illness diagnosis, 92.3% of critical illness claims for conditions such as cancer, heart attack and stroke, and 92.6% of income protection claims to help customers get back to work after a health crisis.

The report details how customers are supported through Aviva’s claims and rehabilitation process and includes examples of customers’ individual experiences. It also aims to raise awareness around the common reasons why a small number of claims are declined and can be used by advisers to help educate clients on the importance of ensuring that correct information is provided on health and lifestyle.

Further findings from the research support Aviva’s call for more education amongst consumers to limit the possibility of any protection claim being rejected: a third (33%) of people say they have not always being entirely frank with insurers when applying for different types of insurance.

More than half of UK adults (53%) also say they do not bother to read the detail on any insurance policies they purchase.

A similar proportion (54%) also said they only check their insurance policies’ terms and conditions when they need to claim, increasing the possibility of disappointment if a claim is made for something that is not covered by their particular policy, such as a specific illness.

Paul Brencher, Managing Director of Individual Protection at Aviva said: “It’s a common misconception that insurers don’t pay out on protection claims. Our research findings are alarming given our high, actual claims pay-out rates. Aviva is absolutely committed to paying out claims and alongside our strategic partners and independent financial advisers, we have been able to provide financial peace of mind to more than 23,000 individual protection customers and their families in 2016.

“However, claims rates could be even higher if all consumers were aware of the need to take extra care when making an application. Incorrect information, whether deliberate or accidental, and not checking the product details are some of the main reasons why a small proportion of protection claims cannot be paid. We hope that advisers can help us in preventing this, by stressing the importance of being as thorough and clear as possible when applying for insurance.

“As an industry, we must ensure the pervasive myth that insurers don’t pay out isn’t a barrier to families taking steps to protect themselves against an unexpected illness or a death. Publishing claims statistics is a good way for insurers to demonstrate that they put their money where their mouth is and to reassure customers that any future claim will be taken seriously.”

Life insurance and terminal illness benefit

A significant proportion of the claims paid by Aviva last year was on life policies, with more than 15,500 claims paid to beneficiaries or terminally ill customers, reflecting how life insurance is the most commonly held protection policy amongst UK individuals.

The value of these claims to customers, more than £522 million, is not far short of the total UK government expenditure on bereavement benefits in 2015-2016 (£569 million)***, expenditure that is expected to reduce following changes last month to how bereavement benefits are paid.

Just over 1% of death and terminal illness claims made were declined. The most common reasons for Aviva not being able to pay a claim were due to misrepresentation of important medical information during the application process, which would have prevented or changed the ability to provide cover, and terminal illness claims being made when the customer’s prognosis did not yet meet the 12 month criteria.

Critical illness

More than £311 million was paid in 2016 to customers diagnosed with a critical illness. The average pay-out of £72,871, demonstrates the valuable benefit that this type of protection can provide if a serious illness is diagnosed. More than 4,000 claims were paid, helping to alleviate immediate financial concerns that families inevitably face due to a significant illness.

Two-fifths of all claims on Aviva’s critical illness policies were made by customers aged 40-49, with women more likely to claim in their 40s than men (45% of claims by women v’s 35% of claims by men). Cancer remains the most common cause at 63% of all claims, (50% of all claims by men and 74% of all claims by women). Other leading causes were heart attack (9%), stroke (6%) and multiple sclerosis (5%).

92.3% of all critical illness claims were paid in 2016. Of the 7.6% of claims that could not be paid, 6.6% were due to the condition not being covered by the policy. The remainder were due to misrepresentation, where the customer’s statements about their health and lifestyle during the application process had not been accurate and would have affected the cover and premiums that could be provided at the time.

Income Protection

More than 3,500 customers received income protection benefit during 2016 following a loss of income through illness or injury, with £37 million in benefit payments.

The average age at which customers were unable to work through illness or injury was 45 years, and nearly a third (29%) of claims were made by customers aged under 40.

The most common reason for customers claiming income protection benefit was because of a mental health condition, accounting for around a third of claims (28%) last year. Musculoskeletal conditions such as back or neck injuries accounted for one in five claims (20%), while cancer was the third most common reason for claim (12%).

Of the small proportion (7.4%) of claims in 2016 that could not be paid, around a third arose because the customer did not meet the policy’s definition of total disability in which they were totally unable to carry out their occupation. Equal proportions were declined either because there was no loss of income experienced by the customer or because of misrepresentation of relevant medical information which would have affected the ability to offer cover.

The Aviva Individual Protection Claims Report is available to download here.

|