However, underneath the confidence, which is particularly prevalent among larger businesses, caution prevails. Almost one third of UK business leaders (30%) are cautious about the operating environment – three times more than at any point in the past year, with 80% characterising it as ‘moderate to high’ risk.

Dave Brosnan, CEO, CNA Hardy said: “UK business leaders’ sentiment is clear. While stability has brought something of a recovery of confidence, companies remain cautious, because they see serious issues on the horizon, including Brexit, the UK’s current slow economic growth, and the possibility of a global trade war. In this environment, companies are worried about a wide range of risks, and will need, more than ever, to manage their own risk profile with care and caution.”

European business leaders are more confident in their ability to prosper than their UK counterparts, with 76% counting themselves confident in Spring ‘18.

The survey also highlights that a range of difficult changes are combining to create a higher-risk operational environment for businesses.

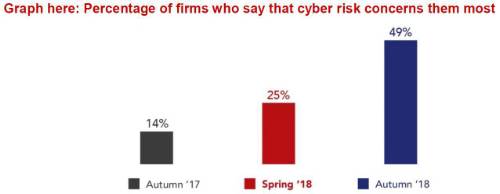

Cyber risk becomes a leading concern

Cyber risk now tops the risk ranking for the first time in our research both in terms of what worries business leaders today and, what they think will dominate their concerns in six months’ time. 25% of executives now rate cyber risk as their highest risk concern, rising to 49% as we look ahead to Autumn ‘18. Interviewees noted that last year’s high profile cyber attacks raised awareness of cyber as a threat in a different league: state-sponsored, broad-ranging and a credible threat to public and private assets.

By contrast technology risk was only rated top risk by 11% of business leaders.

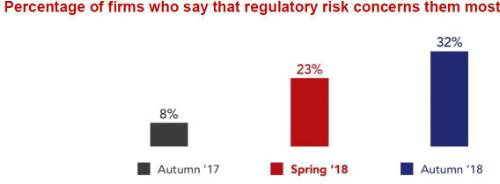

Regulatory risk becomes a major preoccupation

The most significant and unexpected finding of the survey is that regulatory risk, which barely registered as a concern in previous surveys, has broken through as the second-most concerning risk on the C-suite agenda after cyber – seen as a key risk by 23% of executives, rising to 32% as we move into Autumn ‘18.

Reasons given by interviewees for this heightened attention to regulatory risk include:

? The impact of the introduction of GDPR in May 2018

? The introduction of the Gender Pay Gap regulations and the increased focus on gender issues following the #metoo campaign

? The expectation of as-yet-unconfirmed changes to international trade regulations after Brexit

? Continued impacts from the 2015 Modern Slavery rules on supply chain management

While Brexit continues to polarise opinion among survey respondents in terms of its likely impact, in the short term it is a regulatory double whammy – British businesses must comply with current and pending regulation whilst also preparing for the upheaval that exit will necessarily entail. The survey reflected that larger businesses have more resource and manpower to deal with this, leaving them notably more confident than mid-size and smaller businesses in our survey.

Patrick Gage, Chief Underwriting Officer, CNA Hardy said: “Risk management has now become complex for many businesses, and also fast-moving. This has brought operational change. Many firms are devoting much resource to the twin dangers of cyber attack and data loss (and as a consequence to their own GDPR preparation). We also see evidence that firms are turning their operational and management resource towards the rising tide of regulatory risk. However, the lens is perhaps too tightly focused. While firms may be working on the specific operational patches to manage these challenges, they are not yet following through to see how it can affect and increase supply chain risk or their overall corporate risk. We believe the risk environment is moving too fast for many businesses to keep up, and as an insurer, our role is to support and advise our clients in this fast-changing environment.”

Corporate and supply chain risk fail to register

The Spring ’18 research shows that corporate and supply chain risk are still failing to capture the attention of the C-suite. Only 10% of executives are prioritising corporate risk – defined as the risk of fraud, corruption, poor governance or pensions exposure. Even fewer, 8%, rank supply chain as their top risk.

Dave Brosnan, CEO, CNA Hardy said: “In our last Risk and Confidence survey we highlighted how companies’ failure to recognise a trio of boardroom risks – corporate, regulatory and supply chain - was threatening growth plans. In this report, we are pleased to note that companies have recognised regulatory risk. However, they are still not giving corporate and supply chain risk the attention they deserve. Only 8% of business leaders rate supply chain as their top risk today and businesses consistently fail to rate supply chain as a top concern. This is in spite of the fact that the triggers for supply chain disruption are growing ever more numerous and severe, and causes of supply chain failure can range from local weather to global politics.”

Download the full report here

|