|

|

More than four out of five motor and home insurance customers have been left annoyed when calling an insurance company in the past year, new research1 from insurance experts Consumer Intelligence shows. |

Its nationwide study1 found 83% have been angered by calls to firms over the past year with the biggest complaint being staff who are hard to understand.

Around 72% of motor and home insurance customers have phoned their company in the past year with just one in six saying they ended a call without being annoyed at any stage.

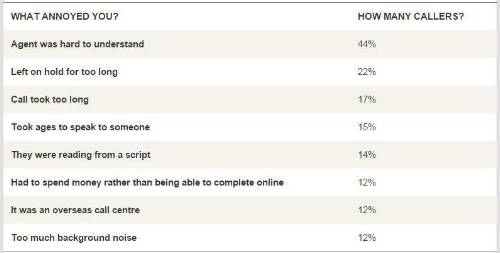

Of those who were annoyed more than two-fifths (44%) said insurance staff were difficult to understand when explaining policies while 22% complained about being on hold for too long and 17% said the call took too long.

The main reason for calling was to discuss a renewal quote with 45% phoning to ask about their new price while 24% were calling to change policy details and 15% were ringing to get an online quote reduced.

Ian Hughes, Chief Executive of Consumer Intelligence said: “Insurance companies work hard to attract new customers and retain their existing customers and achieve general high levels of customer satisfaction.

“But it is clear that phone rage is affecting huge numbers of customers with calls ending up with people being left annoyed.

“Insurance doesn’t have to be complex and many customers do want to stay loyal so firms need to look at how their phone calls are being handled.”

The table below shows the top reasons for insurance phone rage.

Consumer Intelligence’s research1 shows 25% of people who have renewed or bought motor or home insurance in the past three months used the phone at some point. It has launched a new service for insurers called Web2Phone which monitors call handling for firms.

|

|

|

|

| Take the lead client-facing projects ... | ||

| Various locations - Negotiable | ||

| Choose Life! Choose a major global co... | ||

| Various locations - Negotiable | ||

| Actuarial skillset? Apply now for Snr... | ||

| South East / hybrid with travel requirements - Negotiable | ||

| Financial Risk Leader - ALM Oversight | ||

| Flex / hybrid - Negotiable | ||

| Be the very model of a modern Capital... | ||

| London - Negotiable | ||

| Pensions Actuary seeking a high-impac... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Great opportunity for Pensions Actuar... | ||

| London or Scotland / hybrid 3dpw office-based - Negotiable | ||

| Responsible Investing Manager - Clima... | ||

| London/Hybrid - Negotiable | ||

| Quant Strategist | ||

| London/Hybrid - Negotiable | ||

| Multiple remote longevity contracts | ||

| Fully remote - Negotiable | ||

| Multiple remote inflation hedging con... | ||

| Fully remote - Negotiable | ||

| Play a vital role in shaping a new He... | ||

| London or Scotland / hybrid 50/50 - Negotiable | ||

| Support the Longevity team of a globa... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

| Delve into financial risk within a ma... | ||

| Wales / South West / hybrid 1dpw office-based - Negotiable | ||

| Project-based Life Pricing Actuarial ... | ||

| South West / hybrid 2 dpw office-based - Negotiable | ||

| Pricing Actuary | ||

| London - £120,000 Per Annum | ||

| Develop your career in motor pricing | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Experience real career growth in home... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Be at the cutting edge of technical p... | ||

| UK-wide / hybrid 2 dpm office-based - Negotiable | ||

| Use your passion for innovation and t... | ||

| London / hybrid 2 days p/w office-based - Negotiable | ||

Be the first to contribute to our definitive actuarial reference forum. Built by actuaries for actuaries.