Stubbornly high deficits couple with changes to IAS19 standards

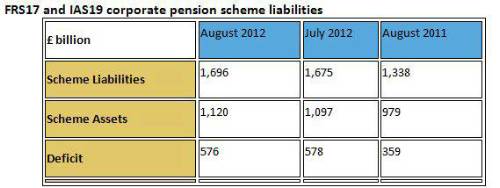

Xafinity Consulting warns that sponsors of corporate pension schemes are heading for significant hikes in their reported pension costs for 2013 as balance sheet deficits hit £576 billion and new accounting requirements come into force.

Source: Xafinity Corporate Pensions Scheme model, based on all UK DB pensions and using FRS17 and IAS19 accounting rules

With corporate bond yields now in clear water below 4%, mid year reporting is backing up the picture presented by Xafinity across all UK corporate pension schemes where deficits are 60% up on where they stood 12 months ago.

The focus has been on the size of these deficits on the balance sheet and we should not be glib about the real impact these can have on the sponsor. In the next twist, new IAS19 requirements will now bring attention onto the size of pension costs against corporate profits.

Hugh Creasy, Director at Xafinity Corporate Solutions, said: “The key tool in managing the size of these pension costs has been the expected return on assets. IAS19 is about to do away with this. Bringing together flat asset values and such a low corporate bond yield will be the worst of circumstances for the Finance Director. With gilt yields down at 2% and corporate bond yields heading back towards them, the outlook for 31 December is sombre.

“This will come as disappointing news for Finance Directors who have seen their scheme asset values hold firm. Now is the time to make plans to manage this before we hit the usual hectic activity at the turn of the year.”

|