More than two in five (44%) 55-64 year-olds plan to move into ‘semi-retirement’ before they reach 65, allowing them to draw on their pension savings while continuing to work part-time, according to new research from Aviva.

The research, from the fourth edition of Aviva’s Age of Ambiguity study, explores changing attitudes towards work and retirement accelerated by the Covid-19 pandemic. Aviva’s findings reveal people’s changing emotional and financial wellbeing as they face up to post-pandemic professional uncertainty.

Positive impact of ‘part-tirement’

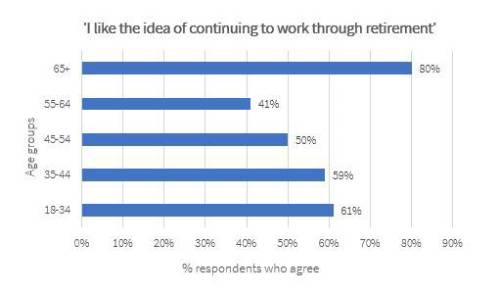

More than nine in ten (91%) people described themselves as “much happier” since reducing their working hours, suggesting that semi- or partial retirement – ‘part-tirement’ – could be the answer for more than half (55%) of workers who like the idea of continuing to work through retirement, giving them freedom in later life, while remaining part of the workforce.

As life expectancy continues to increase and more people than ever are living to 100 and beyond[1], retirement can form up to a third of an individual’s life. Recent changes in government policy, including the planned increase in the state pension age to 67 from 2028, has led people across all age groups to re-evaluate their plans for work and later life.

Almost three in five (59%) 18–34-year-olds say they plan to semi-retire before the age of 65, rising to 61% of those aged 35-44. The findings suggest that elongated working lives are encouraging younger people to think about a flexible approach to working in later life to maintain their career.

The Great Unretirement

Recent ONS data shows that 48,000 over-50s have recently returned to the workforce, as Chancellor Jeremy Hunt urges people who have already retired or are considering retirement to think about partial or full-time employment to help solve some of the UK’s labour shortage issues.

However, Aviva’s research suggests people are in favour of staying in employment beyond their retirement age, suggesting that the problems the UK faces with workplace participation will not exclusively be solved by encouraging people to return to work.

Four in five (80%) over-65s said they liked the idea of working through retirement, with at least two in five (41%) of every age group in favour of the idea.

Continuing to work can help improve mental and physical health, which informs overall wellbeing, as shown by Aviva’s ‘Wellbeing Circle’. It can also keep loneliness and isolation at bay.

The desire to retire early is often driven by individuals wanting to take advantage of more freedom while still being physically fit and well enough to enjoy it. Semi-retirement can offer a mutually beneficial solution for employers and employees, as companies benefit from retaining the expertise and knowledge of skilled staff within the workforce, and workers can make choices about maintaining a healthy lifestyle and income in retirement.

As the workplace continues to evolve, Aviva’s report offers practical solutions around how employers can provide welcoming, cross-generational workplaces. Mastering the Age of Ambiguity gives employers the tools needed to create a winning workplace culture that values its staff, increases employee retention and staff wellbeing all together.

Michele Golunska, Managing Director for Wealth and Advice at Aviva said:“In a climate where longer working lives are becoming the norm, semi-retirement is a chance to experience the ‘best of both’ which can benefit both employees and employers.

“Retaining connection to their workplace is an appealing option for many people who are still working towards their financial goals or are simply not ready to stop working . It also provides an opportunity for employers to continue to harness the knowledge and expertise of more experienced staff for longer.

“We know retirement can look very different for everyone so we want to encourage conversations about retirement long before it happens,. Aviva’s Mid-Life MOT app provides a number of tools to help people between 45 and 60 think about themselves more.

“As people live longer, investing time in ourselves and considering every option available in later life is the best way to ensure we have the retirement we aspire to. Starting to think and plan further ahead is a small step that can make a big, positive difference in the long-term.”

|