By Richard Lunt FIA, Senior Investment Consultant at Xafinity Consulting

Tailored LDI used to be the preserve of very large schemes, but this is no longer the case. There have been a number of pooled LDI fund launches recently and the ‘tool set’ now available to small and medium-sized schemes allows the implementation of hedging strategies that would not look out of place within multi-billion pound arrangements.

Schemes of less than £300m have never had it so good with regards to the number of risk reduction options available.

Do you mean LDI...or LDI?

There are a number of different definitions of LDI depending on who you ask.

For smaller investors, a reasonable holistic definition for many practical purposes – and almost all introductory purposes – is to consider LDI as a way of increasing the extent to which scheme assets and liabilities are likely to move in the same direction. This characteristic reduces the chance of a deficit arising or increasing, and risk is reduced as a result.

The level of risk reduction depends on the specifics of the hedge employed. It isn’t necessarily the case that a ‘full’ LDI hedge will be appropriate at outset, though such a strategy would be associated with a much lower level of risk.

Hedging in practice – calibration with LDI ‘bucket’ funds

There are now a number of fund managers who offer a pick-and-mix range of pooled LDI funds, which can be combined in appropriate proportions in order to reflect a particular scheme’s liability characteristics. The parlance in the industry is LDI ‘bucket’ funds – a term reflecting their practicality but not the level of sophistication and fine-tuning that such funds make possible.

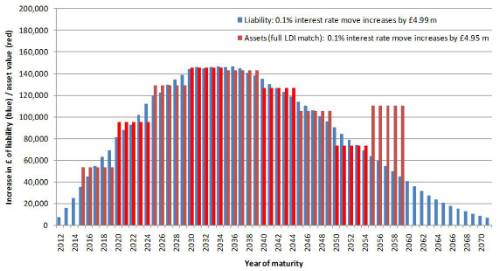

Use of LDI bucket funds is illustrated in Figure 1, which shows the impact of a 0.1% fall across the interest rate spectrum on a scheme’s liabilities (blue) and also a properly-calibrated portfolio of nine pooled LDI funds (red). The hedge is based on LDI funds covering five-year periods (conventions differ between managers), with hedging more than 50 years into the future approximated via an increased hedge on the longest point (reflecting poor market liquidity beyond this point).

The impact of the interest rate fall is an increase of around £5m in the value of both the scheme’s liabilities and its LDI funds, with the increase distribution by year of cashflow shown. The hedge means that the scheme is extremely well protected against interest rate movements.

It is true that a more detailed hedge would be possible with a non-pooled LDI portfolio, though we would consider the additional level of ‘accuracy’ to be tantamount to over-engineering for smaller schemes given the degree of uncertainty inherent in the estimation of the cashflows themselves.

What’s in the bucket?

LDI providers are now offering funds which make use of:

• Swaps – commonly used by the treasury departments of larger corporates e.g. in order to ‘lock in’ to a given loan rate (i.e. to turn a floating rate loan into a fixed rate loan).

• Synthetic gilts – such as gilt repo, a sale and repurchase arrangement which is actively encouraged by the Bank of England (due to the market liquidity it provides).

The lowest cost way of hedging at the time of writing involves the use of swap-based LDI at shorter durations and gilt-based LDI at longer durations. This can be achieved by combining swap-based and gilt-based LDI funds or by delegating this decision to a fund manager, with the latter approach now becoming more common.

These instruments, while often new to sponsors and trustees, are well worth investigating. The markets for both are large and liquid, and such instruments are in common use throughout the industry. For instance, the PPF holds considerable gilt-repo exposure (estimated to be £1bn).

Of course, the big advantage of using LDI funds is the level of capital efficiency it is possible to obtain. We believe that certain LDI ranges offer good-quality tailored hedging for one-third the commitment of capital associated with a similar quality hedge using government bonds. The freed-up capital can then be invested more profitably elsewhere, and allows a given level of investment return to be targeted for considerably reduced risk.

To hedge or not to hedge

Most LDI funds reduce risk by ‘locking in’ to prevailing market conditions and, if conditions then improve post-purchase, it would have been better to wait. The name of the game is to reduce risk at the right price.

LDI market conditions are associated with those of government bonds, which are currently exhibiting record low yields. This doesn’t mean that there is no value to be had though. For instance, the terms for locking into inflation via swaps has been attractive recently, potentially allowing at least some protection to be put in place at reasonable-looking market levels.

Hedging can then be increased at an appropriate juncture, which could depend on agreed market-based triggers being hit or being framed around an objective of ‘banking’ improvements in funding level as and when they occur.

|