The index, which analysed over 335,000 public tweets about 15 of the country’s major insurers, showed that the insurance industry experienced more negative conversation on social media than positive - resulting in an industry Net Sentiment of -19.2%.

Overall, of the 15 insurers included in the index, Marmalade obtained the highest Net Sentiment of 15.5% and was one of only two insurers to achieve a positive overall score. Over the period in question each tweet received a sentiment rating — positive, neutral, or negative. These scores were then used to calculate a Net Sentiment score for each insurer.

Alex Bertolotti, UK Insurance leader for PwC, said: “We are facing an increased dependency on digital channels across the sector so the results should prove sobering news for some insurers.

“However, this insight can also be an opportunity for insurers to offer a point of differentiation in what is a complex and competitive market.

“By focusing on service delivery, digital transformation can be the very thing that can both move the dial in terms of customer service and performance, while offering up the opportunity to streamline costs.

“As expectations evolve and the industry transforms, insurers will need to choose their own path as they contribute to a bold new vision for the industry.

“Regardless of the path they choose, insurers that anchor their strategy around developing an agile, tech-powered organisation will create a distinct competitive advantage.”

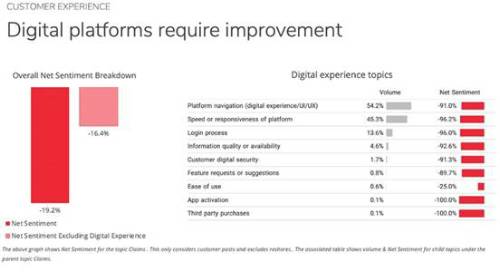

According to the results the majority of negative tweets referred specifically to feedback about past, present and potential customers’ experience of how the insurer operated such as website navigation, app and website downtime and network speed. However, insurers publicly responded to 71% of priority tweets, with almost a third without a response. Hastings Direct performed the best in this regard, with a response rate of 90.9%.

Response time was also varied across the insurers with nine brands responding under the industry average of 8.1 hours. Direct Line performed best in this category, with an average response time of just 2.2 hours - almost 6 hours faster than the industry average and over 18 hours faster than the slowest brand.

|