Analysis of ONS figures reveals that the lowest income group (the bottom quintile) on average receive less State Pension income than all other higher income groups, and less income from other benefits than all but the group with the highest incomes.

“The common assumption is that those with the lowest incomes get the most State help but that’s not what the reality is,” said Stephen Lowe, group communications director at Just Group.

“The figures show that the 20% of pensioners with the lowest incomes receive the least money from the State.”

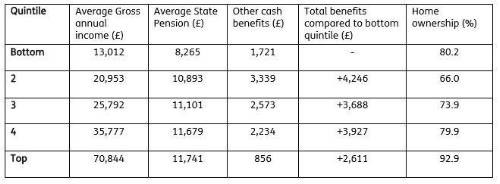

The UK’s pensioner households are divided into five groups, or quintiles, with each one representing about 1.5 million pensioner households. Those on the lowest incomes receive an average of £8,265 State Pension and £1,721 in other cash benefits totalling £9,986 a year.

Households in the group with the next lowest incomes (the second quintile) receive £14,232 in total from the State - £4,246 a year more than the lowest income group. Even those on the highest incomes receive £12,597 a year from the State - £2,611 more income from the State than those on the lowest incomes.

“Even if you exclude State Pension income and just look at other cash benefits, people with the lowest incomes still receive less than all but those in the very top income bracket,” said Stephen Lowe.

“The other striking fact is the very high levels of home ownership among those on the lowest incomes. More than 80% of those in the lowest income group own their homes which is higher than every other income group except the top income group.

“Government figures show that about 1.2 million households fail to claim about £2.5 billion a year in Pension Credit, equal to more than £2,000 income for each household2. This analysis shows it may be homeowners struggling on poor incomes who are most likely to be missing out, perhaps because they think the value tied up in their homes means they are not eligible for other benefits.”

He said the figures reinforced the need for State Benefits information to be given a high priority within the free, impartial and independent pension guidance available from Pension Wise to those considering accessing their pension money.

“Retirement planning is not just about making good choices with pensions, but also understanding the wider context of retirement and what other support is available,” he said.

“Homeowners in particular appear less likely to claim their eligible benefits so could benefit from a reminder at this key time of their lives.”

|