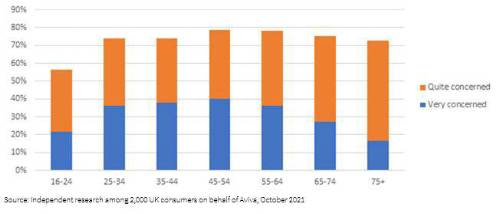

With annual inflation having recorded its largest ever monthly rise from July to August[1], 79% of people aged 45-54 are worried about spiralling living costs, including two in five (40%) who are very concerned.

Those aged 55-64 are the second most affected group with 78% registering concern about the upwards trajectory of prices for everyday essentials, as UK petrol prices approach an all-time high[2] and energy bills soar[3].

Graph 1: Concerns about rising inflation and living costs among UK adults, October 2021

The findings come at a fragile moment for consumer confidence across the UK, with the end of lockdown causing anxiety to increase as people attempt to put the experience of Covid-19 restrictions behind them.

More than one in three adults (35%) say they feel more anxious about their future compared to before the pandemic, with those aged 45-54 the worst affected (42%). Across all age groups, more than one in four (28%) report heightened stress levels since lockdown ended while a similar figure (27%) say their sleeping habits have deteriorated.

Restricted movements during the first Covid-19 lockdown saw households’ monthly savings temporarily soar to an unprecedented £27.5 billion in May 2020[4]. Most recently, the £9.1 billion deposited with banks and building societies in August 2021 remains high compared to the pre-pandemic monthly average of £4.7 billion.

However, Aviva’s research suggests the end of lockdown is putting renewed pressure on savings habits. Only 32% feel lockdown helped them to build a bigger savings pot for the future, with those aged 55-64 most likely to disagree (42%).

One in three people across all age groups say they have become more committed to saving since lockdown ended. Yet one in five say they have already spent the additional savings they put aside during lockdown, while one in four predict their lockdown savings pot will be exhausted by the end of the year.

More than one in three (34%) people aged 45-54 say they are able to save less now than they were before the pandemic, along with 28% of those aged 55-64.

Alistair McQueen, Head of Savings & Retirement at Aviva, comments: “For anyone approaching retirement, the balancing act between spending and saving can be a big factor in future decisions about their commitments. The pandemic experience has prompted many people to stop and think about what matters most in life, and the end of lockdown means thoughts can now start to shift towards revisiting long-term plans.

“Looking at savings trends before, during and after the pandemic, it’s vital we remember decisions to save or not to save should not be a case of ‘all or nothing’. Realistically the exceptional circumstances of being confined in our homes will remain the high water mark of many people’s savings habits, but putting away a smaller percentage of your monthly income where possible can still add up over the long term.

“Keeping your finances under regular review and shopping around for better deals can help you feel in control of your money. Tools like Aviva’s Mid-Life MOT app provide a way to take stock of your work, wealth and wellbeing needs to prioritise and take practical steps to improve your present and future prospects.”

|