The latest findings, calculated using Retirement Advantage’s Equity Release Property Value Tracker, come after Key Retirement has announced an all-time record half year lending figure of £934m for H1 2016, up 24% from H1 2015.

Alice Watson, product and communications manager at Retirement Advantage Equity Release, said: “It’s amazing to see that, despite unprecedented political and economic uncertainty following the EU referendum, the property wealth available to over 55s through equity release continues to grow. It’s too early to tell what impact the Brexit vote will have on housing wealth but, if mortgage lending conditions tighten as the result of a post-referendum economic slowdown, it could enhance the appeal of equity release.

“The latest record-breaking figures from the ERC demonstrate how an increasing proportion of this demographic is accessing the wealth stored in their homes to facilitate a more enjoyable and fulfilling retirement. Our customers are increasingly using equity release for home improvements, gifting to family members and holidays.”

“Over the past three months we’ve seen new entrants to the market, innovative partnerships and welcome changes to the FCA’s affordability assessments. These developments are great news for the consumer and have no doubt helped to further boost equity release’s already surging popularity.”

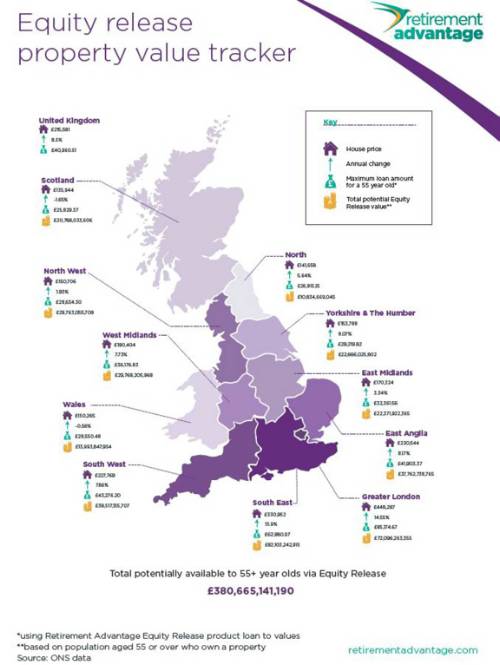

The latest Retirement Advantage Property Value Tracker finds that house prices are rising fastest in regions outside of Greater London, with the capital suffering its first quarterly drop in property values since Q4 2012. The North of England (+7.2%) saw the greatest quarterly increase in wealth available, followed by Yorkshire and the Humber (+6.6%) and the West Midlands (+5.6%).

Meanwhile growth in Greater London (-0.04%) stagnated over the quarter and was comparatively slow across the South East (+2.8%). The two regions top the table for annual growth, however, reporting uplifts of 14.6% and 13.9% respectively, with East Anglia (+8.2%) taking third place.

Alice Watson added: “We’ve noted for some time that the value of property wealth available to over 55s outside of London is increasingly catching-up with the capital and these latest figures shine a spotlight on the trend like never before. This regional growth undoubtedly spells opportunity for homeowners right across the country.

“Despite rapid growth in its popularity, we’re still seeing less than 1% of equity release’s potential realised. Over the coming years, this popularity will increase further, with over 55s taking an increasingly holistic approach to retirement finance which has equity release alongside pensions and investments.”

|