Protheroe said: “At the end of October the aggregate [PPF] shortfall was just under £150 billion, down from the peak of over £400 billion at the end of August 2016. On average schemes are planning to take seven and a half years to close those shortfalls. In general we believe that is affordable and realistc. Most employers with DB schemes will remain in business, and gradually eliminate their deficits. While they do so, they will continue to pay full benefits to scheme members.”

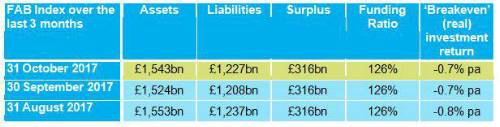

This echoes the message coming out of First Actuarial’s Best estimate (FAB) Index, which confirmed that the best estimate position of the UK’s 6,000 DB pension schemes remained stable over October, showing another month-end surplus of £316bn, and a steady 126% funding ratio.

First Actuarial Partner Rob Hammond said: “We produced the FAB Index with the purpose of giving Trustees, employers and members, both sides of the story so that they could properly assess the amount of prudence being used in scheme funding.

“Another purpose was to counter the persistently negative headlines on pension scheme deficits that, in the wrong hands, could scare members into making bad decisions.

“Sara rightly defends the PPF as providing good quality protection for the 11 million members who participate in a defined benefit pension scheme, and it is welcome to hear somebody else who shares our concerns on deficit scaremongering.”

The technical bit…

Over the month to 31 October 2017, the FAB Index did not move, with the surplus in the UK’s 6,000 defined benefit (DB) pension schemes remaining at £316bn.

The deficit on the PPF 7800 Index improved over October from £158.0bn to £149.8bn.

These are the underlying numbers used to calculate the FAB Index.

The overall investment return required for the UK’s 6,000 DB pension schemes to be 100% funded on a best estimate basis – the so called ‘breakeven’ (real) investment return – has remained at around minus 0.7% pa. That means the schemes need an overall actual (nominal) return of 2.9% pa for the assets to meet the liabilities.

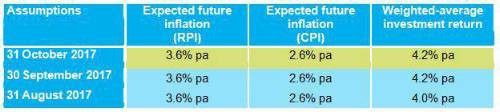

The assumptions underlying the FAB Index are shown below:

|