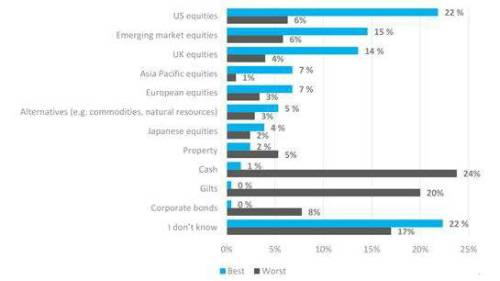

UK equity funds have seen record outflows since the Referendum in June 2016 but despite this, a high number (14%) of advisers put this asset in their predicted top three best performing asset classes. Similarly, despite recent falls, US equities (22%) and emerging market equities (15%) were also ranked highly by advisers.

While cash may be viewed by some as a safe haven during times of volatility, research shows that advisers expect cash (24%) to be the worst performing asset over the next year. Gilts are ranked in second place (19%) as the asset class advisers predict will perform the worse, with corporate bonds in third place (8%).

The mixed predictions of advisers reflects current market volatility and political instability, with a high proportion (22%) of advisers unsure of the asset class they would predict to generate the best returns over the next 12 months.

Research shows that views on the asset classes expected to generate the best returns for clients differs depending on the advisers average client portfolio value. For advisers whose clients’ have an average pot of £200,000 or more, Asia Pacific assets are predicted to be the fourth highest performing asset at 11%, compared to the 4% figure for advisers whose clients’ pot is on average under £100,000. Similarly, advisers whose clients’ have an average pot of under £100,000 are more likely (6%) than advisers whose clients’ have an average pot of over £200,000 (2%) to expect Japanese equities to perform well in the next 12 months.

Nick Dixon, Investment Director at Aegon, said: “In this highly volatile investment landscape, advisers are right to question whether the longest bull market in history could be coming to an end. When it comes to investment decisions, advisers and investors are having to face a number of concerns head on. This includes the impact of geopolitical stress on emerging markets, equity valuations, and potential impact of Brexit on UK equities. However, our research shows that advisers remain level-headed in the face of a very fickle market. Advisers are right to remain focused on long-term returns, diversification, and avoid reacting to fast moving market conditions.”

|