Analysis by actuarial consultancy OAC (part of the Broadstone Group) of Premium Bonds distribution modelling demonstrates the likely winnings of a median saver after the prize fund rate increases to 4% from August – from 3.7% in July – the highest in over a decade.

What does the prize rate increase mean for savers? The first thing to understand is that the 4% prize fund does not equal a 4% return on a saver’s money.

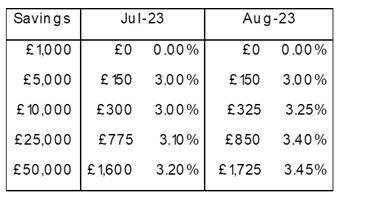

When you order all the prize winners over a year, the person in the middle with average luck – the median saver – would get a lower return than 4%. For example, if you have the maximum £50,000 saved, the median saver’s likely return is just 3.45%.

However, the odds of savers winning a prize in August will increase by 9% with the odds falling from 24,000-1 to 22,000-1 compared to July due to the rate increase.

While a median saver with £1,000 in savings will still likely win nothing over the course of a year, because the odds of winning any prize have lowered, the saver’s median return for those with around £9,900 or more invested in Premium Bonds is now larger.

For example, the median saver with £25,000 in Premium Bonds in August would have a median return of 3.4% which works out at an average annual return of £850. This compares favourably to July where a median saver was likely to see 3.1% returns equalling just £775 over a 12-month period.

Those with larger savings pots similarly benefit from larger, more frequent wins – a £50,000 median saver sees their returns rise from 3.2% to 3.45% amounting to a £125 increase (change from £1,600 to £1,725).

Greig Bingham, Head of Financial Modelling at OAC, commented: “The increase to the prize rate means that savers now stand a far better chance of winning in the Premium Bonds.

“While it is difficult to quantify what the prize money will translate into for a regular Premium Bond saver, by using this financial modelling we are able to work out the annual returns for a saver with average luck.

“While the median return lags behind many cash savings accounts which have upped their rates in the wake up of rising interest rates, the slim possibility of scooping a life-changing sum may be enough to attract more savers to Premium Bonds.”

|