The insurer states that British families, with their low savings rates , need to be better prepared for the unthinkable, especially since the median UK take-home pay is less than £28,000. In reality, the impact of an early death in the family has an even greater impact, especially when factors such as childcare, standard of living and leisure possibilities are considered. Moreover, the cost of living is rising, and inflation and elevated interest rates are putting major financial pressure on British households. Yet only 30-35% of UK adults have life insurance cover to protect loved ones in the event of their premature death.

Even in a family where both partners are equal earners, the removal of one income often makes the continued cost of living for the survivor unaffordable on their earnings alone. Certainly, maintaining previous standards of living is often extremely difficult, resulting in a family downsizing or moving to rented accommodation, for instance. Add to this the fact that many households have little or no savings – with 50% of 18-40s saying they have less than £2,500 saved in a recent survey – and the situation rapidly becomes critical.

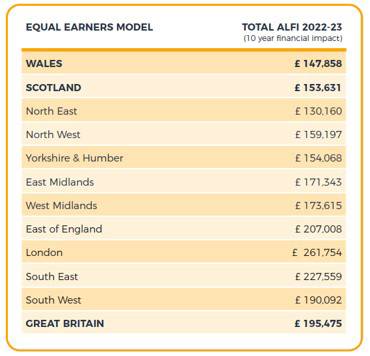

To support people’s ability to assess their own situation and consider what level of life insurance might be adequate to protect the survivor and their children should their partner die, Beagle Street commissioned an objective estimate from independent research organisation MindMetre. The study drew on high-quality datasets to provide a financial assessment for British regions.

ALFI (Adverse Life-event Financial Impact) is built on the basis of a ‘defined family structure’, with two partners as household parents with two children, where the partners earn equal salary. The financial impact covers ten years until the children achieve adulthood.

Beagle Street Associate Marketing and Distribution Director, Beth Tait, said, “Our ALFI model is just a starting point for the most basic financial impact of a premature death, which in reality may be much higher, to cope with additional costs of running a family as a single, bereaved person. Although it’s not the easiest topic to discuss, it’s so important to understand what the impact of losing a contributing partner might be, given the responsibility of bringing up children while also potentially paying for a mortgage. It’s crucial to plan ahead to ensure families are protected financially should the worst happen.”

The full report, ‘Adverse Life-event Financial Impact’, can be freely downloaded here

|