-

Parents spend an average of £163 on presents per child for Christmas

-

This could add up to £4,347* in savings over 18 years

-

Nearly one third of parents said their child (29%) would prefer to receive money rather than gifts for Christmas

On average, parents spend £163 on Christmas presents for their children, averaging between nine and 10 presents per child. This is despite the fact that research has found that nearly one third of parents with a child aged six to 18 (29%) believe that they would prefer to receive money at Christmas over a gift.

Currently those parents whose child has received money for Christmas believe they receive around £88 on average. A third (32%) say their children spend all the cash, and fewer than one in 10 (8%) save all the money.

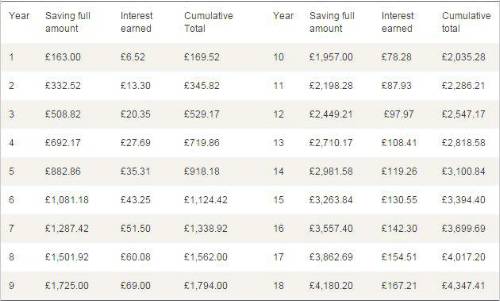

If the money spent annually on Christmas gifts were to be placed in the Halifax Junior Cash ISA for each year over an 18 year period, parents could see a nest egg for their child grow to almost £4,347, having earned almost £1,413 in interest alone. (See table 1)

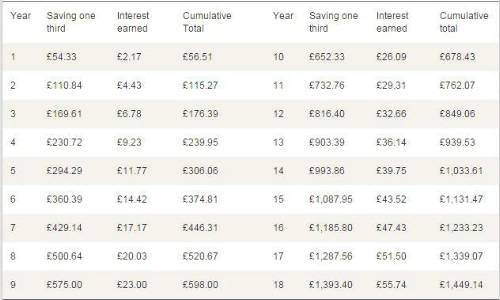

For families looking to put just a little aside at Christmas for their child's future savings pot, just saving a third of this outlay each year over 18 years would see a savings pot of nearly

£1,449 build up, including interest of almost £471. (See table 2)

Research reveals that two thirds (63%) of parents have savings accounts for all their children, with the average savings total for each child amounting to £1,225. This is significantly less than the potential total nest-egg that parents could accumulate if they chose savings over present buying at Christmas.

Richard Fearon, Head of Savings at Halifax, said:

“Whilst we appreciate that most parents would not choose to forgo all their children’s Christmas presents, this research demonstrates how setting just some of the Christmas budget aside could significantly add up over the long term.

“With just under a third of children wanting to receive money for Christmas, it is more important than ever to ensure that any savings that can be made are put to the best use. Starting a nest egg for your child’s future could be one Christmas present they are truly grateful for in the years to come.”

Additional Findings (when asking parents about children aged 1 to 18)

-

Children in Scotland have the most money spent on them at Christmas, averaging £213.00 per child.

-

Parents in the South and the North spend the least on presents for their children averaging £138.00.

-

In London, the North and the South, parents are most likely to believe that their children would prefer money to presents (36% and 35% respectively).

-

Of those children that receive money for Christmas, those in the East of England and Wales receive the most money for Christmas, averaging £138 per child.

Table 1

Table 2

*assumes money is invested in Halifax Junior Isa with interest earned at current variable rate of 4% tax free AER *source Halifax

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 1010 GB parents of children aged 18 or under. Fieldwork was undertaken between 2nd - 4th December 2014. The survey was carried out online. The figures have been weighted and are representative of all GB adults (aged 18+).

|