• Partnership will enable Primetime to provide advisers with best available fixed terms annuity rates

• Advisers think fixed term annuity market set to grow by 26% in the next two years, according to research by Primetime

Innovative retirement income specialist, Primetime Retirement is expanding the distribution network for its market-leading fixed-term annuity products which have recently been launched on the Avelo Exchange Portal.

The link with Avelo, which has 30,000 registered users and features more than 350 products from 50-plus providers, is a significant step forward for Primetime as it seeks to grow the fixed-term annuity market.

It believes the deal with Avelo, which processed over 300,000 online transactions last year, will help more advisers access the benefits of fixed-term annuities for healthy customers.

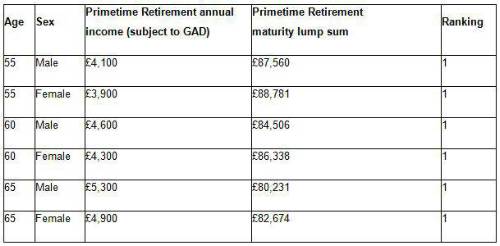

Primetime Retirement Marketing Director Stuart Wilson said: “We’re delighted to have partnered with Avelo to offer our fixed term annuities through the Avelo Exchange Portal. These annuities currently produce the highest income on the market for men and women aged 55, 60 and 65. Working with Avelo will allow us to offer our product range to more advisers on a wider scale.”

The Primetime Retirement Plan is a deposit-based investment which offers advisers and clients a combination of a fixed income for six years which is not affected by age or gender; and a Protected Maturity Amount at the end of the six-year term which they can use to purchase another appropriate pension product. It also offers Value Protection Plus death benefit, a valuable lump sum benefit for those looking to pass on as much of their fund as possible should they die prematurely. Commission for advisers is 2.75%.

The 7th Issue of the plan will also include additional income flexibility for those IFAs looking to target a specific outcome for the client.

Stuart Wilson continues: “Advisers have a genuine opportunity to add real value to their retirement business at a time when clients approaching or at the point of retirement are changing their views on what retirement means. Those who are in good health and still working want to keep their options open in retirement and need retirement income solutions which are flexible enough to adapt.

“We are not only offering market-leading rates, but we are now offering IFAs the chance to target a specific income or a specific maturity sum, depending on their client’s needs, which offers even greater flexibility.”

Research by Primetime shows that more than three quarters (77%) of specialist retirement income advisers expect the fixed term annuity market to grow in the next two years and those advisers anticipating growth believe that on average, the market will grow by 26%.

Dave Miller, Head of Portal at Avelo said: “Opportunity and choice should be available to everyone when it comes to selecting an annuity, for that reason we are pleased to give our Exchange Portal users access to the widest range of products and providers in the market.

“This partnership with PrimeTime ensures that our advisers have access to a high quality product and increased choice at a time when the annuity market is set to change dramatically as a result of the EU Gender Directive.”

Primetime Retirement fixed term annuity rates and income

Source: Avelo Exchange. Provider Calculated Rate*

Research by Primetime shows that more than three quarters (77%) of specialist retirement income advisers expect the fixed term annuity market to grow in the next two years and those advisers anticipating growth believe that on average, the market will grow by 26%.

From the 27th August 2012, commission for advisers will be 2.75%.

For those clients looking to boost the potential purchasing power of their maturity fund, Primetime Retirement also offers a variety of investment upside alternatives to their core plan, using a Structured Deposit that links an additional maturity lump sum to the performance of the FTSE 100 Share Index. Clients can choose either the Accumulation+ plan, aimed at those who are still saving for retirement; the Capital+ Plan, for those seeking income and potentially higher growth; or Income+, for those looking for higher income.

The next Issue of the Primetime Retirement Plan and the upside options opens on Monday 17th September. More details are available at www.primetimeretirement.co.uk

|