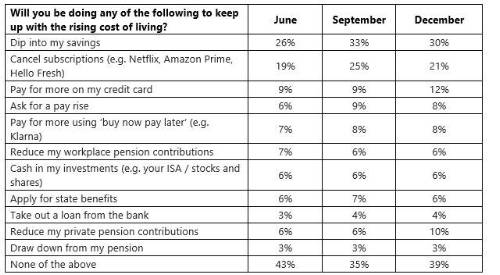

While the number of those dipping into their savings accounts (down from 33% to 30%) and cancelling subscriptions (25% to 21%) has decreased since September, worryingly, more now intend to spend more on their credit card (up from 9% to 12%) or cut back on their private pension (up from 6% to 10%). This use of credit cards is notably more favourable among younger individuals (17%), who are now relying on BNPL services twice as much (16%) as those aged 35-54 (8%).

Thankfully, workplace pension contributions seem to remain unaffected by peoples’ budget adjustments – with the number of those looking to reduce contributions unchanged since September (6%). However, December has now shown an increase of people reducing their private pension contributions (up from 6% to 10%) suggesting a growing number of individuals cutting their long-term savings to deal with the immediate impact.

Mark Futcher, Partner & Head of DC at Barnett Waddingham, comments: “In face of the worsening economic climate, it’s no surprise that people are continuing to adjust budgets to see themselves through the winter period – with some demographics taking more drastic measures than others. And while some trends may reflect an adjustment for the festive period, these figures highlight a continued concern for people’s savings in the long-term.

“An increased use of credit can be a worrying figure to see, particularly with interest rates predicted to rise imminently, and suggests people are relying on quick access to credit to get by. Reassuringly, cutting back on workplace pensions hasn’t become a growing trend, and people should only consider this as a last resort. While it may help to alleviate immediate financial pressures, this still means turning down ‘free’ contributions from the taxman and your employer.

“Hopefully the trend towards cutting private pensions doesn’t translate into the workplace, and we advise anyone considering this to talk to their employer first. They may be able to up employer contributions to workplace schemes or even consider continuing to pay employee contributions if you need to pause contributions temporarily. “

|