The retirement specialist found that seven in 10 (72%) had experienced one or more life events that could result in vulnerability such as physical or mental health problems, bereavement, job loss or relationship breakdown. But of those, only 16% mentioned the circumstances to their adviser.

Stephen Lowe, group communications director at Just Group, said that although clients were a little more willing to talk to advisers compared to other organisations such as employers, utility companies or banks, the numbers willing to disclose potential vulnerability are worryingly low.

“There is increasing scrutiny on advisers to identify and support vulnerable customers but the research shows the majority of people are unlikely voluntarily to divulge their own vulnerability,” he said.

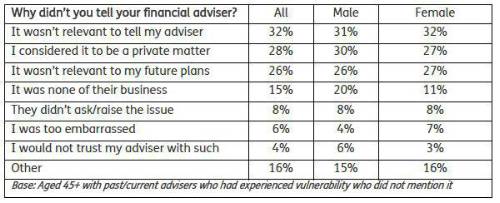

“Among the reasons given for people not to mention it was that they felt it was not relevant to their

adviser or future plans, that they weren’t asked, or they were just embarrassed.”

The Just Group research shows many clients would be more willing to divulge information about vulnerability if their advice firm was more pro-active with engagement and education. Among the ideas that found favour were providing clients with checklists, emphasising the importance of disclosure and asking more questions.

Those clients who had disclosed their circumstances to advisers met with a mixed response. Positive comments included people saying the adviser was more understanding about the client’s emotional situation after marriage break-up, were more compassionate and more sympathetic to those impacted by illness in the family. However, in about a third of cases they said disclosure made no difference.

Stephen Lowe said that some important conclusions could be drawn from the research about how a firm could go forward with their vulnerable customer strategy in future.

“Clients seem much more likely to talk about their circumstances if the adviser has previously highlighted it as important and expected,” he said. “That means touchpoints such as reviews and communications should be used educate and reinforce the message about vulnerability.

“While the majority may react positively to this kind of active engagement that still leaves a sizeable rump of clients who still may resist. There is an opportunity for the industry to keep working together and sharing best practice to ensure we can meet our regulatory responsibilities.”

He said it was important that clients who do divulge vulnerable circumstances are made to feel they made the right choice in terms of extra care and attention they receive.

Just Group and SOLLA recently updated their interactive training module Consumer Vulnerability in Later Life. Since launch in 2019 it has been used by more than 10,000 advisers, paraplanners and other financial professionals and has been recognised by the Financial Conduct Authority as an example of how providers can support advisers.

|