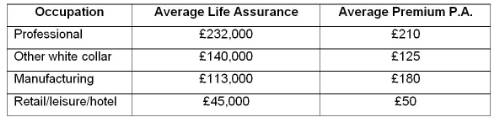

The research found that average life assurance for those in this sector is £232,000. This compares to £45,000 for those working in the retail, leisure and hotel sectors, who receive the least, the research found.

The average cost of life assurance for those in the professional sector is £210 a year per person, the study found. This would appear to be much better value than the cost of the benefit for those in the manufacturing sector. At £180 it is almost the same price as that for staff in the professional sector, but manufacturing employees only receive £113,000 per annum.

Commenting on the findings, Punter Southall Health & Protection consultant Paul White said:

“There are several reasons, based on actuarial risk calculations, why the cost of group life assurance for manufacturing employees is relatively expensive compared to their professional services contemporaries. One is that manufacturing plants tend to be in areas of the country where life expectancies are somewhat lower, in contrast to areas where professional services employees are more likely to live.

“Secondly, manufacturing jobs are more likely to involve work which may cause health problems, such as musculo-skeletal conditions; and even in some case fatalities through industrial accidents.”

Those in the manufacturing sector can perhaps take some comfort from the fact that while their life assurance benefits are less than those in professional services occupations, they are still better than for those in the retail, leisure and hotel sectors, who only enjoy an average life assurance benefit of £45,000 a year.

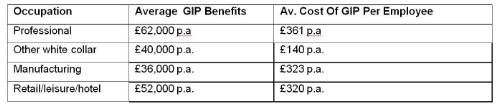

As well as enjoying the best life assurance benefits, those in the professional services sector also receive the best group income protection (GIP) benefits. They have the highest average salary and typically the richest benefit formulae, according to the Punter Southall Health & Protection research.

“Not only is GIP less frequently given to those in manufacturing than to those in professional services, it is also rarely provided on a universal or democratic basis, tending to be limited to managers and those in more senior positions,” says White.

“Also, like life assurance, the cost of the benefit is very similar for employees in manufacturing as for those in professional services, despite the fact that those in the latter have far higher average salaries. This is again because there are lifestyle and occupational factors with manufacturing workers - the likelihood of an unskilled labourer suffering a long-term disability at any given age could be three or four times greater than a professional employee.”

Whereas with life assurance the research found that the average benefit and costs for those in retail, leisure and the hotel sectors were the lowest, for GIP the research seems to suggest they are better paid than those in the “other white collar” group.

“This seems counter intuitive,” says White. “However, the explanation for this is that while life assurance is reasonably customary as a benefit for all sectors, GIP is more common in white collar jobs. However in the retail, leisure and the hotel sectors, where it exists, it tends to be limited to senior managers and above. So we are comparing the typical salary for senior employees in the retail, leisure and hotel sectors, with the average salary for a more democratic population in the other categories.”

1The research defines professionals as professions requiring professional qualifications, such as lawyers, senior bankers and senior positions in insurance.

|