Whilst professional trustee firms are not new, the evolution of the traditional trustee model for UK pension schemes is accelerating the growth of a small but incredibly powerful industry.

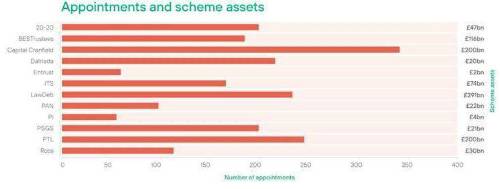

In Isio’s Professional Independent Trustee Survey 2021, the 12 featured larger firms are appointed to 1,900 pension schemes and have responsibility and influence over a mammoth £800 billion, equivalent to nearly six months of UK GDP and around a third of all UK occupational pension scheme assets. They oversee investment and funding decisions which have macro-economic, environmental and societal impacts, hold £100s of billions of UK government debt and protect the retirement incomes for millions of UK workers.

Whilst pension fund trustees typically include lay trustees, consisting of pensioners, employees and company executives, the professional trustee firms are growing in size and influence as they become more prevalent on trustee boards. And, increasingly these professional firms have sole responsibility for running the pension fund.

A growing industry

The firms estimate that around 50% of pension schemes have a professional independent trustee with an expectation that the majority of schemes will appoint one or more over the coming years.

The survey found that whilst the organisations are generally modest in size, with a typical headcount of 50-100 employees, they are growing quickly, reporting 10% growth in appointments and 14% growth in revenue in 2020. A number have also had private equity investors in recent years, fuelling their appetite for growth.

A more modern, but expert approach

And with this expansion comes a modernisation. Professional trustees are increasingly younger, looking for a career rather than a wind-down to retirement, and reflect greater diversity than 10 years ago. Roughly a quarter of the trustee representatives in the survey have a background as a pension manager or consultant, with another 25% coming from actuarial backgrounds. The remainder is made up of a mix of lawyers, investment experts, covenant advisers and trustees with broader business backgrounds.

Longer term impact

With a number of the firms believing they could double in size over the next five years, the shift to appointing professional trustees and, increasingly, sole corporate trustee appointments will inevitably change the shape of the market with the likelihood of consolidation amongst firms.

Mike Smedley, partner at Isio commented: “The professional independent trustees market is a fascinating combination of the large and the small.

“On one hand, you could fit the Trustees in our survey on to three London buses. They deal with day-to-day decisions like ruling on recipients of individual death benefits and managing the accuracy of pension payments.

“On the other hand, they have responsibility for £800bn of retirement savings and four million members. They can hire and fire advisers and fund managers in firms that dwarf their own - their influence is phenomenal.

“With this report we wanted to set a benchmark and explore who these trustees are, what is driving expansion and what the future holds against a background of increasing regulation. One particular growth area we’re keen to watch is the rise in sole corporate trustee roles, where the firm acts as the only trustee to the pension scheme. One in three appointments are already sole trustee roles and this growth is expected to continue as the model evolves.”

The chart shows the number of pension trustee appointments held by each firm together with an estimate of the total assets in those pension schemes. Naturally, the asset figures are heavily influenced by appointments to the very largest schemes.

|