Isio has published its 2025 Professional Independent Trustee Survey, revealing that professional trustee firms have established an integral role within the UK’s defined benefit (DB) pensions industry.

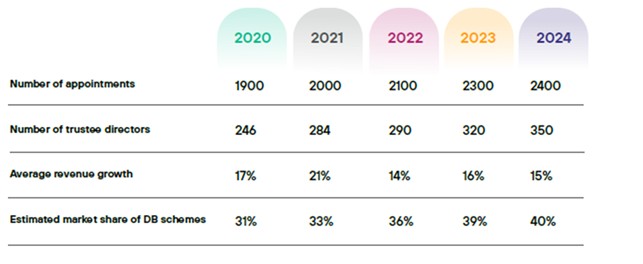

Isio surveyed the 10 largest professional trustee firms in the UK and found these firms now manage over 2,400 pension schemes, up from 2,300 in 2023, with a combined asset value of more than £1 trillion. The ten firms are increasing their influence on the market and are responsible for the management of almost half (43%) of UK DB pension schemes, up from four-fifths (39%) in 2023.

The findings indicate these firms continue to grow in scale and influence and are of increasing importance to the UK pensions landscape. They support recent action from The Pensions Regulator (TPR), which plans to introduce a new regulatory framework to ensure oversight of professional trusteeship.

Reflecting their increasing dominance, Isio’s research also reveals that the 10 firms saw a year-on-year increase in trustee directors and revenue growth. The number of trustee directors increased from 320 in 2023 to 350 in 2024, while average revenue was up 15%, marking the fifth consecutive year of double-digit revenue growth. Isio expects the influence and reach of these firms will continue to grow and projects they could be accountable for the management of two-thirds of the DB market within the next five years.

Huge growth projected for corporate sole trusteeship

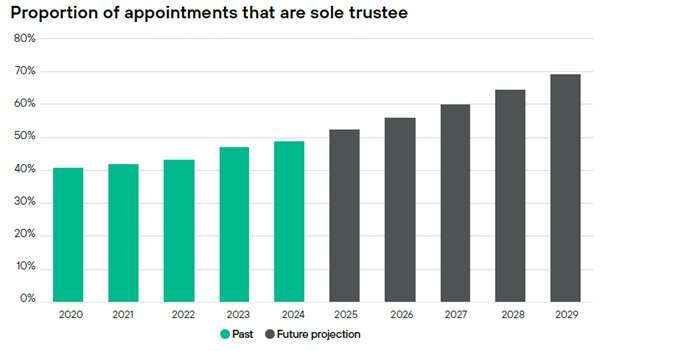

The trend for corporate sole trusteeship remains a key driver of growth in the professional trustee sector. Corporate sole trustee appointments now account for nearly half (48%) of all appointments, up from 41% in 2020. This shift reflects the efficiencies of the sole trusteeship model, which streamlines operations and enables quicker decision making without relying heavily on trustee meeting schedules or the need for trustee upskilling.

Professional corporate sole trustees now oversee approximately £70 billion in assets, with the largest scheme currently around £3.4 billion in assets. Isio found 50 existing trustee appointments moved to a sole corporate trustee in 2024 and projects that corporate sole trustee roles could represent almost 70% of all appointments in the next five years.

Progress continues on diverse representation

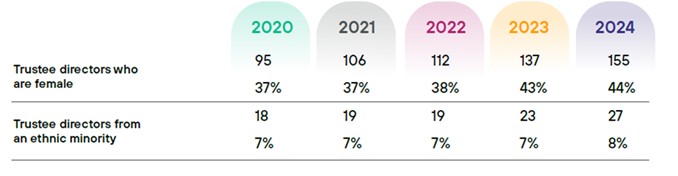

Reflecting TPR’s focus on improving diversity within the sector, professional trustee firms continue to make strides in equality, diversity and inclusion (EDI). Isio’s Survey reveals that almost half (44%) of trustee directors at the ten largest firms are female, compared to just under one-quarter (24%) in the wider trustee market1.

The Survey indicates a slower increase in the representation of ethnic minorities; just 8% of trustee directors at the ten firms come from ethnic minority backgrounds, versus 5% in the wider sector.

Mid-tier firms

Outside of the 10 large firms, several other firms are actively competing for appointments. The Survey highlights 7 mid-tier firms that collectively hold around 200 appointments and manage £13bn in assets. As these firms continue to grow, some may transition into the large firm category over the next few years.

|