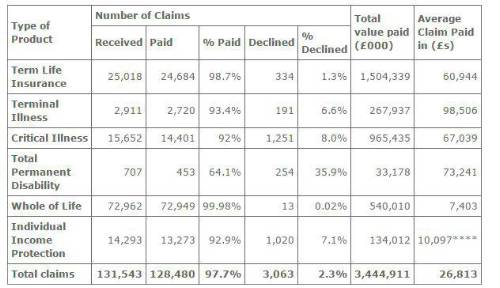

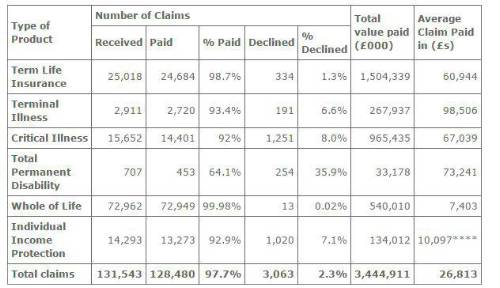

Every day, insurers pay out on average £9.4m to help more than 350 individuals and their families cope with the financial strains and worries that can be caused by a life changing event. In particular, these figures show that almost all (99.98%) of whole life insurance policies are paid out, worth £540m up from £450m in 2013.

James Dalton, ABI Director in charge of protection policy said:

"At the most stressful times, insurance can make a real difference. These figures show that 97.7% of all types of protection policy claims are paid allowing people to focus on other challenges**. As well as relieving the financial strain, insurance policies can provide support during a difficult time. For example, income protection policies can offer rehabilitation and back to work support services.

"However, many households still have no real financial safety net. Each year, one million workers suddenly find themselves unable to work for more than four weeks due to serious illness or injury*. Insurance can play a role in improving families’ financial security, to help them after the loss of a loved one or support them if they are unable to work."

The latest data published by the ABI shows that in 2014:

The average claim paid in 2014 for individual income protection (IP) policies was just over £10,000, paying out on average for 204 weeks (nearly four years), worth £39,200, to help those unable to work. 92.9% of claims were paid out. (See Notes for Editors and accompanying Q+A for definitions and details of group income protection claims).

The average pay-out in 2014 on a critical illness (CI) insurance policy was £67,000. The percentage of CI insurance claims being paid continues to rise, with 92% paid (up from 80% in 2005). There has been a steady rise in the percentage of claims paid since the introduction of the ABI’s Code of Practice on non-disclosure, first issued in 2008, which clarified which medical information customers needed to share with insurers.

The average pay-out on a term life insurance policy was £60,900 with 98.7% of claims being paid. In 2014, insurers paid out more than £1.5 billion in claims.

For whole life insurance the average claim payment was £7,400 with almost all (99.98%) of claims paid. In total £540 million was paid out in 2014.

Total Permanent Disability claims averaged £73,200 with 64.1% of claims paid in 2014, up from 50% in 2009. Before the ABI introduced the standard definition for Total Permanent Disability (TPD) in the Critical Illness Statement of Best Practice in 2011 there was no standard definition of what circumstances qualified as “total permanent disability”. This lack of clarity lead to claims being made that did not qualify. The introduction of the Statement of Best Practice has meant that the share of declined claims has steadily fallen; this trend will continue as all new TPD policies are tested against the industry standard set by the ABI.

Examples of people who have been helped by protection insurance policies:

Dave, 39 years old, became unable to work because of Chronic Fatigue Syndrome/Myalgic Encephalomyelistis in 2010 (CFS/ME). He claimed on his income protection policy with Zurich, and within a month, was receiving £1,000 per month in benefit and a full rehabilitation programme including one-to-one coaching and cognitive behavioural therapy sessions, which means he’s been able to return to work.

Commenting on his policy, Dave said: "With the right support I’ve been able to take better control of the emotional implications of my condition, progressing into a new paid job and the beginnings of a new lease of life which fits around my lifestyle requirements of living with CFS/ME."

Kerry, 42 years old, was diagnosed with breast cancer in 2012 when she had a very small daughter. She forgot she had taken out critical illness cover linked to mortgage life insurance in 2002, but was reminded by a Facebook group. She contacted her insurer, Aviva, to make a claim and received around £66,000 which she used to pay off her mortgage. This has given her peace of mind, knowing the financial security she has for her daughter should anything happen in the future.

*Claims paid includes those that were in payment at the start of the year and new claims where a decision was made during the year. Group income protection claims are excluded.

**Excluding group income protection.

***Centre for Economic and Social Inclusion research for the ABI’s policy paper ‘Welfare Reform for the 21st Century’.

****Individual Income Protection policies may pay out for a few months or for many years. This figure is an average of all new and on-going claims during 2014.

|