Individual policies paid out 287,000 life insurance, income protection and critical illness claims in 2022, totalling £4.64 billion. The average pay-out from these policies increased for the third year in a row, from £14,931 to £15,448 (9%). Group policies, which provide protection products through an employer, paid out £2.21 billion in claims.

Number of individual income protection claims increased by 9%

Over 15,900 people claimed against their individual income protection policies in 2022, an 9% increase from the previous year. The total value of claims also increased by 22%, with £231 million paid to people who were unable to work.

Claims for musculoskeletal issues such as neck and back pain were the main cause for an individual income protection claim, accounting for 34%. This is the second year in a row that musculoskeletal issues have been the leading cause of claims.

Covid-related claims plummet by 64%

Individual covid claims plummeted by 64%, from 10,606 in 2021 to 3,846 in 2022. They now only represent 1.3% of the total number of all protection claims paid.

Fewer covid-related claims also led to an almost 73% drop in their total value, to £71 million. The average pay-out for each claim also fell by 29% to £17,434.

Claims acceptance rates remains at around 98%

The number of new individual claims paid has remained consistent at around 98% since 2017. In more than half of the declined claims, customers had not told their insurer key details about themselves or their circumstances when they took out the policy.

ABI Head of Protection and Health Rebecca Deegan said: “When you suffer a loss, fall ill or are badly injured, the last thing you want to be worrying about is your finances, especially during a cost of living crisis. That’s why the security that protection products can provide is so important. With another year of bumper figures and the vast majority of these claims being paid, it’s encouraging to see that individuals and their families continue to be supported through insurance.”

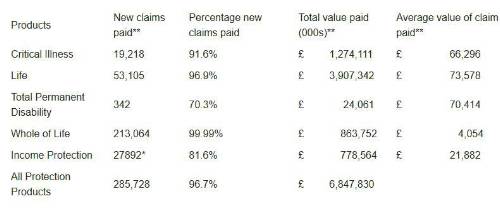

Breakdown of combined individual and group data

*Includes figures from the Association of Financial Mutuals

**Figures are for new claims, as well as income protection claims in payment

Products explained

Critical Illness: A policy that pays out a lump sum when the policyholder is diagnosed with a specified illness. Cancer is the most common cause of claim.?

Term Life Insurance: A policy that will cover the policyholder for a specified number of years, usually until retirement age. This policy pays a lump sum, commonly used to cover outstanding mortgage payments, if the policyholder dies unexpectedly or prematurely.?

Total Permanent Disability: This benefit pays a lump sum, or lifelong payments to the policyholder if they become permanently disabled.?

Whole of life Insurance: A product that covers the policyholder until the day they die. It allows the policyholder to build a small pot of savings to use to cover funeral costs, or to leave a small inheritance to family members.?

Income Protection: A policy designed to help fill income gaps when a person is unable to work due to illness or injury. It will usually cover a percentage of the policyholder's salary and will often provide support services to help employees back into work.

|