Individual policies paid out more than 275,000 life insurance, income protection and critical illness claims, totalling £4.85 billion. This represents a 5% increase in the number of individual claims paid and a 14% increase in the total value of claims paid compared to 2022.

Total value of individual critical illness claims increased to record £1.2 billion

This figure reflects a £136 million (13%) rise compared to 2022 data. The number of critical illness claims also increased by 10% from 2022, with the average claim for 2023 at £67,267.

Continuing the trend from recent years, cancer remained the most common cause for these claims, totalling £777 million.

Total payout for individual income protection claims hit £177 million

This is an increase of £3 million (2%) compared to 2022, bringing the average claim payout up to £9,425.

These increases occurred despite a drop in the number of individual income protection claims in 2023. During the Covid-19 pandemic, we saw a rise in the number of individual income protection claims, and the figures have gradually dropped since 2021.

Musculoskeletal issues such as neck and back pain were the main cause for an individual income protection claim in 2023, though mental illness claims accounted for the highest value at £37 million.

As of 2023, more than 1,660 individual income protection claims have been in payment over 10 years, with 376 of those claims in payment for more than 20 years.

Claims acceptance remain high at 98.3%

The number of new individual claims paid has remained consistent above 98%. The average claim paid rose by 9% to £17,053 compared to £15,643 in 2022.

Common reasons for declined claims were policyholders failing to disclose existing medical conditions when they took out the policy, and not meeting the policy definitions.

Yvonne Braun, Director of Policy, Long Term Savings, Health and Protection at the ABI, said: “Every single day in 2023, the protection insurance industry paid out over £20 million to individuals and families affected by serious accidents, illnesses or even the deaths of loved ones. The financial impact of these events can be devastating, adding even more stress to traumatic situations.

“These figures demonstrate that insurance plays a crucial role in supporting people financially when they need it most.”

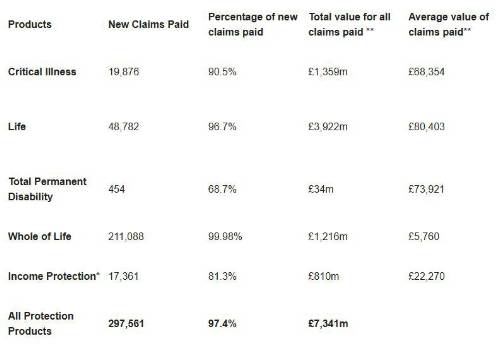

Breakdown of combined individual and group claims using data from the ABI and GRiD

*Includes figures from the Association of Financial Mutuals

**Figures are for both new claims and income protection claims in payment

|