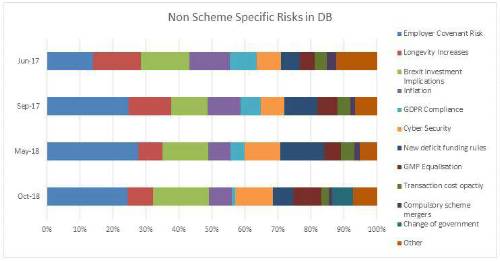

The full year of results, detailed below, show the aggregate number of votes each risk received as a proportion of all the risks selected.

Richard Butcher, Managing Director at PTL, said: “There are a few interesting stories in this quarter’s numbers, especially when viewed in the broader context of the last year. The longevity risk score ticked up a little, but that’s in the context of it already being half what it was a year ago. The indicators that life expectancy is flattening and even reducing could, of course, have a significant impact on DB schemes where, roughly speaking, a one-year increase or decrease in life expectancy can change liability values by 4%.

"In the middle of the table cyber risk has ticked up too. This may be because trustees are becoming increasingly aware of the complexity and difficulty of keeping systems secure. While a pension scheme may not be the obvious target for a cybercriminal, we do hold large amounts of data and personal information. Member privacy and security is paramount, so we really cannot be complacent.

“In the meantime, Brexit and its impact on investment is an increasing risk for trustees. While this may not be surprising, it’s quite difficult to see how the risk can be materially and meaningfully mitigated, we are in the land of the unknown when it comes to Brexit! There is also an emerging category that seems to be more than just Brexit fears. We had a few comments in the “other” category that could be grouped under the heading “total investment market correction” – an unmitigated, correlated collapse. This seems to indicate a general nervousness about the markets and about the world. As we enter a new quarter and soon a new year, we’ll be looking to test this further.”

Butcher continued, “What’s also interesting is to look at the longer picture – how perceived risks have ebbed and flowed over the course of the year. The survey is giving us some rich data and as we continue to collect more statistics, we’ll be able to draw even more robust and detailed findings.”

|