Falls in quoted car insurance premiums are accelerating dropping a record 6.0% in the past three months and by 8.8% in the past year, according to the latest Consumer Intelligence Car Insurance Price Index.

The fall in quoted premiums in the past three months is the biggest since Consumer Intelligence first started tracking in October 2013. Unde-25s saw quoted premiums fall by 8.1% since October last year but by just 0.1% in the past year.

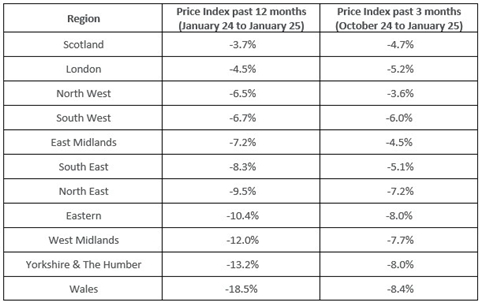

Drivers in Wales saw the biggest fall in the past year at 18.5% and the steepest decrease in the past three months at 8.4%. Yorkshire & The Humber, West Midlands and Eastern region also experienced double digit falls in the past year. Drivers most commonly received a quote between £250 and £499 with 25% of quotes falling in this range and 22% between £500 and £750. Data shows 62% of drivers could obtain a quote for less than £750 in January this year from price comparison websites compared with 49% last year

“The number of brands advertising price cut offers on price comparison websites has hit a new high. In part it is due to the number of tiered products but it still shows the level of price competition,” says Max Thompson, Insurance Insight Manager at Consumer Intelligence.

“The new Ogden rate of +0.5% which came into effect on January 11th has potentially benefited younger drivers most as it means settlements for claims with long-term damages are reduced. However fewer brands appear at the top of results for younger drivers which can mean the market is more reliant on fewer firms,”

Long-term view

Average quoted premiums have risen by 103.9% – slightly more than doubled – since October 2013 when Consumer Intelligence began collecting data.

The over-50s have seen the largest increase, with premiums rising by 132.0%, while the under-25s have experienced the smallest rise at 33.0%. Drivers aged between 25 and 49 have seen average quoted premiums increase by 124.1%.

Age differences in the past year

The under-25s saw the biggest drop in quoted premiums over the past three months at 8.1% compared with 5.7% for those aged 25 to 49 and 5.5% for the over-50s. Over the past year however falls in quoted premiums for the under-25s were a marginal 0.1% and way behind the 8.0% drop for those aged 25 to 49 and 14.3% for the over-50s.

Telematics

The proportion of the rank one to five quotes that are from telematics providers rose to 17% in January from 13% in October. All age groups benefited with 38% of the rank one to five quotes for under-25s provided by telematics providers compared with 35% in October. The proportion of rank to five quotes from telematics for those aged between 25 and 49 rose to 15% from 12% and to 9% from 7% for the over-50s.

Regional differences

All regions saw falls in average quoted premiums over the past year with the biggest drop in Wales at 18.5% and the smallest in Scotland at 3.7%. A further three areas saw double digit drops including Yorkshire & The Humber (13.2%), West Midlands (12.0%) and Eastern region (10.4%). Wales also recorded the biggest drop over the past three months at 8.4% followed by Yorkshire & The Humber and Eastern region at 8.0%. The smallest fall in the three months was in the North West at 3.6%

|