In just a decade, auto-enrolment has helped increase the number of people saving for retirement and embed a savings culture within UK workplaces. In this period, a number of rule changes have increased auto-enrolment contribution levels, and with its ten-year anniversary next week, analysis from Standard Life, part of Phoenix Group, reveals the impact this has had on people’s overall retirement funds.

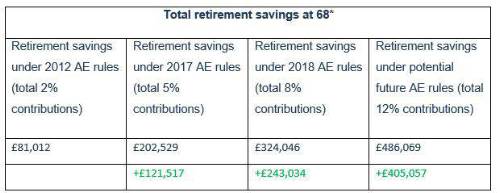

The analysis finds that those who begin working on a salary of £23,000 per year and pay the current standard monthly auto-enrolment contributions (3% employee, 5% employer) from the age of 22, would have a total retirement fund of £324,046 by the age of 68. These contribution levels have been in place since 2018, however, if the contributions rates set at launch in 2012 hadn’t changed in 2018 savers would have accumulated just £81,012 and be around £243,000 worse off.

While increases to the contribution rates have had such a positive impact on saving levels, if auto-enrolment rules were extended further, for example bringing minimum contributions up to 12%, this could lead to savers achieving around £162,023 more in retirement. In the short term this needs to be balanced against the cost of living crisis, however these figures highlight the potential positive impact that changing minimum auto-enrolment contribution rates on retirement outcomes in the long-run.

*if beginning working with a salary of £23,000 per year and paying monthly contributions into a workplace pension at the age of 22 and assuming 3.50% salary growth per year. This is based on current auto-enrolment qualifying earnings of £6,240- £50,270. These are subject to change.

Gail Izat, Workplace Managing Director at Standard Life said: “There’s no doubt that the introduction of auto-enrolment ten years ago was momentous. It embedded a savings culture in UK workplaces and has meant that many people have started putting funds away for retirement at an early age.

“While these figures show just how beneficial saving regularly over a lifetime can be, for those with aspirations of a comfortable retirement they will need to contribute more if they are going to achieve that target. We believe that while short term financial pressures are understandably the focus now, increasing the minimum contribution level to 12% over the next decade is sensible. If combined with other measures such as the removal of the current lower earnings limit and the opening up of auto-enrolment to 18-year-olds, this will prevent future generations from sleeping walking into retirement while thinking that their savings will be sufficient to support them in later life.

“Given the current economic conditions are putting pressure on both corporate and personal finances it will be important to carefully consider how these changes can be implemented. These changes would likely be phased in over a number of years so it is important for the decisions to be made as soon as is practical, to benefit savers.”

|