The increase in surplus has come about as the value of the liabilities which schemes need to cover fell over June, mainly driven by long-term bond yields continuing to rise. Asset values also fell over the month, but not by as much. So despite market volatility in asset prices, pension surpluses on average continue to increase.

PwC’s Adjusted Funding Index now shows an even higher surplus at £360bn - this assessment incorporates strategic changes available for most pension funds, including a move away from lower-yielding gilt investments to higher-return, income-generating assets, along with a different approach to pre-funding potential life expectancy changes.

Raj Mody, global head of pensions at PwC, said: “DB schemes reaching a record surplus this month is a stark reminder of what pension schemes are about. Assets are invested not just for the sake of it, but to cover long-term pension liabilities - and the value of those liabilities continues to reduce as long-term yields gradually rise.

“Seemingly scheme surpluses are getting bigger and bigger. However, it's important to remember that this is in aggregate - the picture is different at an individual level. While more schemes will now be in surplus, perhaps around 3,500 of them, this will range from very large surpluses to those which are more borderline.

“There are about 1,500 schemes still in deficit. For many of those they will likely just need time to eliminate the deficit, as investment returns come good and prudent margins get released, instead of any additional cash payments from their sponsoring company.

“For those with surpluses at the smaller end of the range, it’s important that trustees and sponsors understand how their surplus has been determined, including what approximations have been made. Sometimes there are ‘unknown unknowns’ unless you know where to look.

“The method for tracking a surplus might use an overly simplistic approach over time, presented in a glossy way through a technology portal, but actually some can be pretty rough and ready under the bonnet. Membership data could be out-of-date, benefit interpretations may not have been independently verified. There might be a disconnect between the actuarial valuation and member administration systems. Financials are volatile and some systems may not be set up to cope well with, for example, much higher than expected inflation. All of these issues and others could serve to rebase what looked like a comfortable surplus position into something more balanced.”

Laura Treece, pensions actuary at PwC, added: “Trustees and sponsors should bear in mind that they might need to use up some of their surplus if any issues come to light for their scheme. For those looking to transfer their pension risk to a third party, we’re seeing a lot of data quality concerns arise in the run up to transactions. If not addressed quickly and managed carefully, dealing with data problems can easily eat up a surplus. For example, we've been brought in to try to salvage a situation where the scheme surplus was originally estimated to be £25m, but now looks like only £5m after some data cleansing.

“Schemes that are looking to transact should plan ahead and identify any discrepancies that could push them off course. This will help them to fix things early on in the process, so they can stay on track to achieve their long-term goals.”

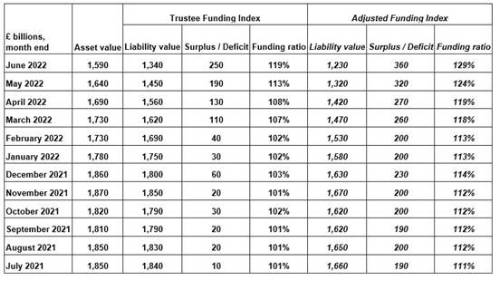

The Pension Trustee Funding Index and Adjusted Funding Index figures are as follows:

|