Reinvesting unused pension income into a new pension scheme can save thousands of pounds in tax.

Analysis by investment firm Skandia shows that someone with a pension of £150,000 entering income drawdown at age 55 and recycling unused income for 10 years could save £28,000 in tax.

Data recently revealed by Skandia shows that 59% of customers in drawdown are not taking an income. These are people that have taken their tax free cash, but have not started taking an income from the remainder of their pension fund. The problem with this is that if they die, the remainder of their pension fund will be subject to a 55% death tax charge.

Part of this can be avoided by recycling pension income. Individuals under age 75 are able to pay contributions of £3,600 a year into a pension, and receive tax relief on those contributions, even if they have no earnings. If someone is working, then they will be able to contribute even more, subject to the maximum annual allowance.

People in drawdown and not taking an income, could create new pension savings by taking an income from their existing drawdown fund to re-invest as a new contribution. There is no net cost to doing this because the income tax paid when taking money out of the existing pension is offset by the tax relief received when investing as new pension savings. There are two key benefits to doing this:

-

no 55% death tax liability on this new pension if they die before age 75 - it can be passed to beneficiaries tax free

-

the newly created pension will provide a further 25% tax free lump sum

Example:

-

money in drawdown at age 55 is £150,000

-

growth rate 7%

-

amount taken as income and re-invested as a contribution is £3,600 a year

-

timeframe - 10 years

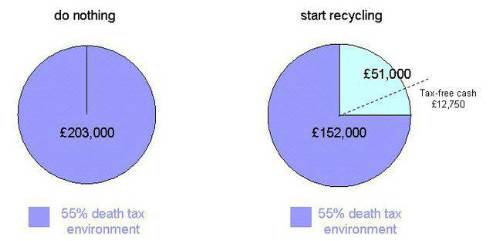

Benefit 1 - By the time the person reaches age 65, their pension fund could be worth £203,000. This is the same value regardless of whether or not they recycle unused pension income. However, the big difference is in the amount of money held within the 55% death tax environment. If the customer were to die at age 65 the amount of the drawdown fund subject to a 55% tax charge could reduce from £203,000 to £152,000, meaning beneficiaries could be £28,000 better off in the lump sum they receive.

Benefit 2 - A new tax-free cash entitlement is built up. After just 10 years, they could benefit from having £12,750 as an additional tax-free lump sum.

The longer this recycling of income continues the greater the benefits. Someone can continue to do this right up until they turn age 75, so, using the above example, there could be 20 years worth of income recycling, which could result in a substantial £34,250 tax-free lump sum.

Adrian Walker, Skandia's pension expert, comments:

"For those sat in drawdown not taking an income, there is an incredible opportunity to reshape their finances to benefit from greater tax efficiency. Recycling unused pension income is not about building a bigger overall pension fund, it is about building a more efficient long term retirement solution - improving both the value of those savings to pass on to beneficiaries and the retirement income they receive.

"The current economic environment has created uncertainty for many and people may take their tax-free cash, but be unsure of the best time to start taking an income, or which income route to choose. People in this situation should seek professional advice, as this procrastination could end up costing them thousands."

Please note: under HMRC rules, ‘recycling' of unused pension income is allowed, but it is not possible to ‘recycle' tax-free cash.

|