Trustees and companies are pre-funding long-term potential future life expectancy improvements - these payments could be made more gradually

Companies could save £30bn a year with alternative approaches

Trustees and companies should get information on life expectancy assumptions in plain English

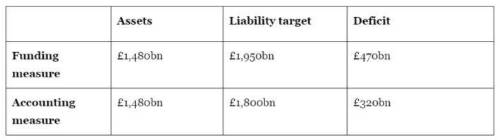

PwC’s Skyval Index, based on the Skyval platform used by pension funds, provides an aggregate health check of the UK’s c.5,800 DB pension funds. The current Skyval Index figures are:

The funding measure is the approach used by pension fund trustees to determine company cash contributions (see notes to editor for definitions on deficit measures).

Raj Mody, PwC’s global head of pensions, said: "We have previously raised the question of whether pension deficits are being measured appropriately and therefore whether financing and risk management strategies are appropriate.

“One particular challenge for pension fund trustees is forecasting future life expectancy for their members. This is notoriously difficult to predict. Because of that, and the requirement for trustees to be prudent when coming up with a target for funding purposes, they typically make an allowance for life expectancy to continue to improve a very long time into the future. However, these pension payments are not yet a commitment - they are just a prudent expectation of what might unfold over the next few decades. Asking companies to stump up the cash over a short-term period, in case of that eventuality, seems over-prudent."

According to PwC's Skyval Index, the additional reserve built into UK pension funding targets could be £230bn in total, out of a current aggregate deficit of £470bn. This is costing companies £30bn a year in pension deficit contributions, which may turn out not to have been necessary, or at least not necessary to pay right now at the expense of other uses for that cash.

Raj Mody added: "A better and more transparent method would be for trustees and companies to repair a more realistic assessment of the deficit over a short-term period, but then keep life expectancy improvements and other such potential developments under review. They can react accordingly over time depending on emerging and continuing trends.

“It's possible that longevity could continue to improve at recent rates, but that is just one scenario. Even if it did, the new pension commitments arising from that wouldn't be payable until several decades from now.

“If a man aged 40 today is projected to live to 85, but that ends up looking more like 90 thanks to medical or health improvements, that extra commitment isn't going to be due until 45 years from now. Similarly, a woman aged 40 now may be expected to live to 87, but could eventually live to 91. Those extra years of pension in 50 years time, in this example, may not need to be pre-funded now. For many pension funds, there could be a more considered and affordable approach to dealing with this."

PwC emphasises the importance of transparent projections for pension fund assumptions.

Raj Mody concluded: "The science of life expectancy projections is full of arcane and technical language, and therefore it may not always be obvious to decision-makers what assumptions they are really making. Trustees and companies should ask for information on these assumptions in plain English. They need to know how long fund members of various different ages are assumed to live to, and how this compares to current experience both for the fund in question and in the population generally. This may help as a sense-check on the realism or otherwise of the assumptions, instead of just going with industry average approaches."

|