With markets falling amidst concerns about the Eurozone debt and the global economy, the Association of Investment Companies (AIC) has compared regular investing with the equivalent lump sum investment during volatile markets.

The AIC looked at the last two bear markets to help illustrate the advantages of regular investing during periods of market volatility.

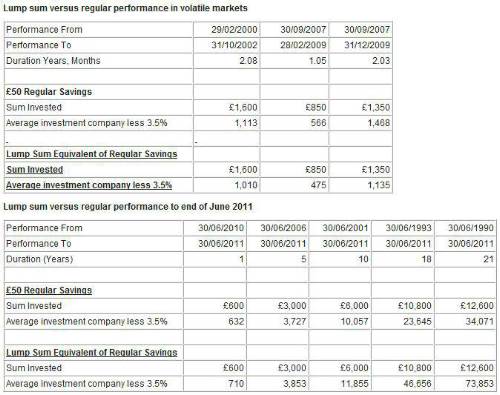

The AIC looked at the last bear markets from 30 September 2007 to 28 February 2009 and from 29 February 2000 to 31 October 2002 and in each of these bear markets regular investing does better than the equivalent lump sum. However, over the longer-term, lump sum investing has historically outperformed (see tables on page 2).

In the last bear market (30 September 2007 to 28 February 2009) a regular investment of £50 per month into the average investment company would have seen a 33% loss in share price total return terms. However the equivalent lump sum investment would have lost 44% - some 10% more. Crucially, if regular investors had continued investing £50 per month to the end of 2009, thereby benefiting from the rally in markets in the second half of that year, regular investors' losses would have turned into a 9% gain, whereas lump sum investors who stayed in the market until the end of December 2009 would still be nursing a 16% loss.

In the bear market starting 29 February 2000 to 31 October 2002 investors would have also lost money through regular and lump sum investing, but again losses were reduced through regular investing. Regular investors investing £50 per month in the average investment company would have made a 30% loss in share price total returns, whereas the equivalent lump sum investment would have lost 37%.

Annabel Brodie-Smith, Communications Director, Association of Investment Companies (AIC) said: "The recent market volatility is understandably concerning for investors but whilst none of us can be sure of the markets' next move, it demonstrates the importance of taking a long-term view of your investments. In the last ten years, despite the market highs and lows, investment companies have performed well with the average investment company up 98%.

"Regular investing each month gives you a lower risk profile by helping to smooth out some of the stomach churning highs and lows in the price of shares. Known as ‘pound cost averaging', it means investors buy less shares when prices are high and more when prices are low and do not have to worry about deciding when the best time to invest is. However, over the longer-term, lump sum investing has outperformed regular investing because investors' money has been invested for longer, benefiting from the stock market's gains. Indeed over 10 years, a £50 per month investment in the average investment company to the end of June has grown to £10,057, whereas the same amount invested as a lump sum (£6,000) over the same time frame has almost doubled, to £11,855."

|