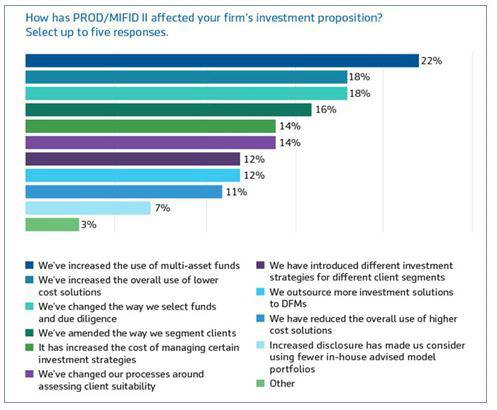

It’s clear from our research that this has caused many advice firms to review their business models. The key question they’re faced with is whether they will be manufacturers of investment products and therefore resource the changes required by PROD and MIFID II, or whether they’ll outsource to third parties.

Aegon asked the advisers who were impacted to tell us the five main changes they’d made. The biggest change was an increase in the use of multi-asset funds, which suggests a move away from in-house models towards outsourcing. 22% say they’ve increased their use of multi-asset funds, and they now make up 32.6% of adviser assets under management (up from 26% in 2019).

Trend towards multi-asset

Multi-asset funds tend to have clearly defined target markets which help with meeting PROD requirements, and in-built governance and reporting processes in line with MIFID II requirements. Moreover, the FCA stresses the importance of customers being able to understand how their savings are invested. Simpler multi-asset strategies with supporting customer communications can help meet this requirement - 26% of advisers note ease of understanding as a reason for recommending multi-asset funds.

As such multi-asset funds are proving to be a straightforward and cost-effective way of demonstrating both client suitability and reporting transparency. Aegon expects this trend to grow as advisers weigh up the cost and complexity of providing their own models against the benefits of choosing an off-the-shelf multi-asset solution.

Greater use of lower-cost solutions

18% of advisers surveyed have increased their overall use of lower-cost solutions, and 11% have reduced use of higher-cost funds as a result of MIFID II and PROD legislation. This is perhaps unsurprising given the regulations’ enhanced scrutiny of value for money in fund recommendations, and the requirement to disclose ex-ante and post-ante costs, making higher ongoing charges figures (OCFs) more visible to clients.

14% of advisers said that MIFID II and PROD had increased the cost of managing certain investment strategies. Enhanced reporting requirements are likely to raise the costs of running in-house model portfolios in particular, and this will have had the greatest impact on smaller firms with leaner budgets and models with lower assets under management.

Supporting segmentation

16% of advisers said they’d amended the way they segment their clients as a result of PROD, 14% said they’d changed suitability assessment processes, and 12% said they’d introduced different investment strategies for different client segments. When asked how they segment their clients, recommendations are overwhelmingly related to clients’ risk appetites and capacity for loss, with 85% citing the former and 75% the latter as amongst their top criteria.

This focus on segmentation processes that came with the PROD requirements may also help explain the increasing attractiveness of ready-made multi-asset solutions that are risk-managed, aimed at clear client segments and can be simpler to match to client needs.

Tim Orton, Managing Director of Investment Solutions at Aegon UK, notes: “There’s clear evidence that PROD and MIFID regulations are prompting the changes the regulator was hoping for, and some advisers are taking a fresh look at how investments are selected and clients are segmented. And whilst there are other factors influencing the trend towards simpler, cheaper investment strategies, our findings highlight a good degree of change since the new rules were introduced.

“Looking forward, we expect to see the FCA’s focus on the consumer investments market accelerate the trend towards straightforward investment solutions, and new ESG-focused regulations such as the Sustainable Finance Disclosure Regulation (SFDR), will help join the dots between sustainability and suitability, and bring investment propositions more into line with the government’s climate action plan.”

|