New research from PwC – Blockchain is here. What’s your next move? – surveyed 600 executives in 15 territories, including 41 in the UK, on their development of blockchain and views on its potential.

Steve Davies, blockchain leader at PwC, commented: “Businesses tell us that they don’t want to be left behind by blockchain, even if at this early stage of its development, concerns on trust and regulation remain. Blockchain by its very definition should engender trust. But in reality, companies confront trust issues at nearly every turn.

“Creating and implementing blockchain to maximise its potential is not an IT project. It’s a transformation of business models, roles, and processes. It needs a clear business case and an ecosystem to support it; with rules, standards and flexibility to deal with regulatory change built in.

“A well-designed blockchain doesn’t just cut out intermediaries, it reduces costs and increases speed, reach, transparency and traceability for many business processes. The benefits can be compelling, if organisations understand what their end game is in using the technology, and match that to their design.”

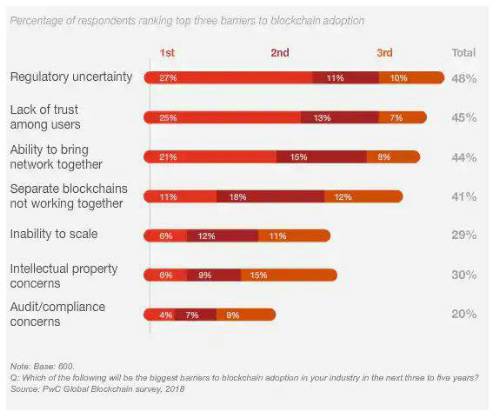

Figure 1: The biggest barriers to blockchain adoption - respondents’ top three challenges

Who’s leading the way?

The survey results reflect the early dominance of financial services developments in blockchain with nearly half of respondents (46%) identifying it as being the leading sector in the near term (three to five years). Sectors identified by respondents with emerging potential within the same timeframe include include energy and utilities (14%), healthcare (14%) and industrial manufacturing (12%).

Looking at leading markets for blockchain developments around the world, the US (29%) and China (18%) are perceived as the most advanced at the moment. However, within three to five years, respondents believe the centre of influence and activity will shift to China (30%), overtaking the US (18%).

Figure 2: Which territories are perceived to be blockchain leaders?

For organisations looking to take their first steps into exploring blockchain, the study identifies four key areas for focus when developing either internal or industry-wide platforms:

Make the business case: Organisations can start small, but need to set out clearly the purpose of the initiative so other participants can identify and align around it.

Build an ecosystem: Participants should come together from different companies in an industry to work on a common set of rules to govern blockchains. Of the 15% of survey respondents who already have live applications, 88% were either leaders or active members of a blockchain consortium.

Design deliberately around what users can see and do: Partners need rules and standards for access permissions. Involving risk professionals including legal, compliance, cybersecurity – from the start will ensure blockchain frameworks that regulators and users can trust.

Navigate regulatory uncertainty: The study warns that blockchain developers should watch but not wait as regulatory requirements will evolve over the coming years. It’s vital to engage with regulators to help shape how the environment evolves.

|