Specifically, a number of lines in the US casualty reinsurance market showed early signs of tightening as reinsurers navigated an uptick in loss ratios and an increase in the frequency of severe losses. Loss experiences were also acute in the property-catastrophe market after a series of diverse and dispersed catastrophes in 2018 – including hurricanes Florence and Michael, typhoons Jebi, Mangkhut and Trami, flooding in Western Japan and the Californian wildfires – cost (re)insurers over USD 80 billion. In addition, a number of large risk losses in several property and specialty classes occurred throughout the year, although abundant capacity generally offset upwards pricing pressures here.

All in, 2018 registers as the fourth most costly catastrophe year ever in real terms and follows record insured catastrophe losses of USD 150 billion in 2017. Together, 2017 and 2018 constitute the most costly two-year period ever for insured catastrophe losses, although they are unlikely to come close to challenging the combined, inflation-adjusted, reinsured losses sustained in 2004 and 2005.

RENEWAL OUTCOMES

GLOBAL MARKET PROPERTY

Capacity constraints in the retrocession market dominated the 1 January 2019 renewal narrative. The quantum and timing of 2018 catastrophe losses was such that a sizeable portion of retrocession capital, the bulk of which is provided by third-party investors, was trapped for a second consecutive year. In addition, investor appetite softened in the fourth quarter, especially when compared to the same period in 2017. Appetite had been moderating throughout 2018 due to lower-than-expected returns and loss deterioration from 2017 events. Many insurance-linked securities (ILS) funds therefore confronted a more challenging environment this renewal, as claims mounted from Hurricane Michael and the California wildfires, both of which were USD 10 billion plus events, as well as Typhon Jebi, the strongest typhoon to hit Japan in 25 years. A series of redemptions and a difficult round of fundraising followed, with lost or trapped capital not being replenished to the same degree as last year.

This contributed to an increase in retrocession rates by double digits on loss-affected layers at 1 January 2019, although the overall pricing picture was more nuanced than in 2018 as distinctions between occurrence and aggregate covers and traditional and ILS markets became more pronounced.

Bradley Maltese, Deputy CEO of UK & Europe, JLT Re, commented: “After another year of significant losses and locked capital in the retrocession market, rates for loss-affected catastrophe layers were generally up by between 10% and 20% on a risk-adjusted basis, with aggregate covers falling towards the upper end of this range. Many clean occurrence retrocession programmes were renewed flat to up 10%. Global and Lloyd’s direct and facultative (D&F) catastrophe covers were less affected by 2018 losses and, after strong increases at last year’s 1 January renewal, rate changes in 2019 were typically down 2.5% to down 7.5% on a risk-adjusted basis.”

REINSURANCE PROPERTY-CATASTROPHE

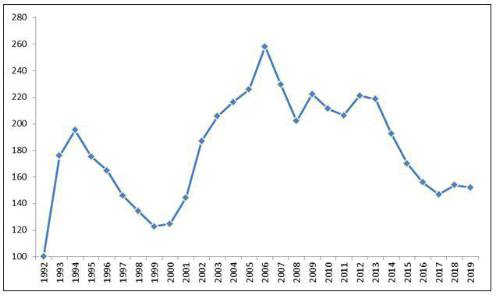

Spillover into the primary property-catastrophe reinsurance market was limited, possibly reflecting the relatively modest amount of loss-affected business up for renewal at 1 January 2019. Figure 1 shows JLT Re’s Risk-Adjusted Global Property-Catastrophe Reinsurance Rate-on-Line (ROL) Index fell by 1.2% at 1 January 2019, after increasing by 4.8% at 1 January 2018. This year’s modest decline leaves the index below levels recorded in 2016. Indeed, the cost of property protection remains competitive with global property-catastrophe pricing approximately 30% below 2013 levels.

Ed Hochberg, Chief Executive Officer, JLT Re in North America, said, “Despite another active catastrophe year in the United States, property-catastrophe rate changes were modest at 1 January 2019. Loss-free layers saw relatively muted movements, typically falling within a range of flat to down 5%. Strongly performing accounts renewed towards the lower end of this range as cedents argued (often successfully) that another clean year merited risk-adjusted decreases in 2019. Loss-impacted layers generally saw price rises, but outcomes varied depending on losses, geographies, exposures and relationships.”

Figure 1: JLT Re’s Risk-Adjusted Global Property-Catastrophe ROL Index – 1992 to 2019 (Source: JLT Re)

Sizeable losses also occurred outside the US in 2018, not least in Japan, but rate movements in Asia Pacific at 1 January 2019 generally saw single-digit reductions due to relatively benign loss activity in the territories that renewed on this date. Pricing pressures were negligible even in the few Asian markets that did sustain losses in 2018 (e.g. China with Typhoon Mangkhut and Indonesia with the Lombok earthquake). Another quiet loss year in Europe generally saw programmes renew flat to moderately down on risk-adjusted basis.

CASUALTY

Another major theme to emerge from the 1 January 2019 renewal was a more challenging environment in the casualty reinsurance market.

Keith Harrison, CEO UK & Europe, JLT Re, said, “A combination of increased severity, social inflation and instances of adverse reserve development has seen reinsurance margins squeezed in a number of casualty lines. This led to more cautious risk appetites, downward pressure on ceding commissions and some upward pressure on reinsurance rates. Specifically, commercial auto, professionally liability, medical malpractice, per person workers’ compensation and umbrella/excess casualty all experienced more challenging renewals than in recent years.”

Mounting pressures were also evident for global casualty as loss-free programmes renewed close to expiring levels whilst moderate increases were observed for loss-affected accounts. Similarly to 2018, these outcomes were often accompanied by lower ceding commissions, particularly for loss-affected programmes.

SPECIALTY

The specialty market typically saw strong levels of capacity offset any upward pricing pressures that came from successive years of rate decreases and rising loss trends. Most programmes were broadly flat or slightly reduced in cash terms, which generally led to risk-adjusted outcomes ranging from flat to down double-digits. Results continue to be strong, despite the attrition fuelled by certain large risk losses affecting the market in the second half of 2018.

UNCHARTED TERRITORY

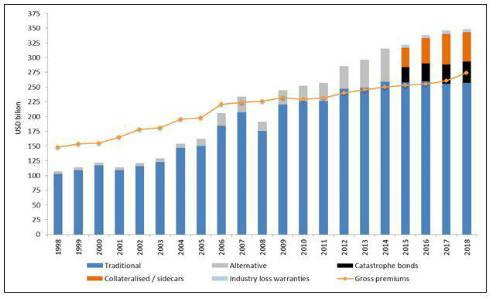

David Flandro, Global Head of Analytics, JLT Re, said, “Sustained capital inflows have offset mounting pricing pressures to bring relative stability to the reinsurance market over the last several years. Record levels of dedicated sector capital at year-end 2018 once again helped ensure continued, plentiful capacity across most lines at 1 January 2019. A small portion of excess sector capital was nevertheless absorbed in 2018 by sizeable insured catastrophe losses in the second half of year, a reduction in third-party deployable capital, higher demand for reinsurance and a renewed focus on underwriting discipline, as shown, for example, by reduced stamp capacity and higher capital requirements at Lloyd’s.”

Figure 2: Dedicated Reinsurance Sector Capital and Gross Written Premiums – 1998 to YE 2018 (Source: JLT Re)

Crucially, early JLT Re analysis indicates that alternative capital growth in 2018 abated for the first time since the global financial crisis. This is consistent with the tightening observed in the retrocession market as some investors pulled back allocations due to what were perceived as disappointing returns throughout the year, continued loss creep from Hurricane Irma and another series of costly catastrophe losses in 2018.

That said, it is important to stress that strong competition at 1 January 2019 ensured that placements, whilst late, were completed in good order for the most part and capacity was only pared back in areas where major losses occurred or where return hurdles were not met. This is a market which has clearly matured since the days when large catastrophes created massive price volatility. The reinsurance sector today remains exceptionally well capitalised, even at a time of macroeconomic change and unprecedented catastrophe loss activity.

David Flandro concludes, “Loss experiences and the macroeconomic environment will play an important role in shaping the reinsurance market in 2019. Another large-loss year could test the limits of carriers’ capital resilience, as well as investors’ appetite for reinsurance at a time of capital market volatility. Carriers’ balance sheets could also come under additional strain as the economic cycle shows signs of shifting for the first time since the immediate aftermath of the financial crisis. Reserving trends and asset leverage remain key sector drivers. After a prolonged period of low yields and disinflation, the spectre of sudden movements in interest rates and asset prices bring important supply implications.”

JLT Re’s prospective market report, which will provide detailed assessments on reinsurance renewal outcomes by individual lines of business, as well as our views on key market drivers in 2019, is being published on 24 January.

|