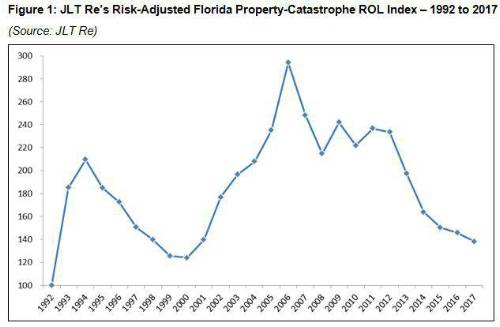

Figure 1 shows that JLT Re’s Risk-Adjusted Florida Property-Catastrophe ROL Index decreased by 5.1% this year. This was within a range of zero to negative 10%, and a greater average reduction than last year’s 3.1% decrease.

Excess capacity and strong competition amongst traditional and insurance-linked securities (ILS) markets, particularly for some of the more sought after placements, were once again instrumental in driving rates down. Specifically, renewed vigour by ILS markets to deploy capital was notable this year as they looked to increase participations, particularly with stronger performing cedents. Losses from Hurricane Matthew had little bearing on renewals, even for cedents whose lower layers were impacted.

Bob Betz, Executive Vice President, JLT Re in North America, said: “While the pace of average rate reductions accelerated at 1 June 2017 compared to last year, the results were very much determined by cedent size and performance. After a difficult 18 months for the Florida insurance market, where attritional losses and mounting litigation related to assignment of benefits (AOB) claims contributed to approximately 40% of state insurers suffering underwriting losses in the first quarter of this year, smaller companies with capital surplus of less than USD 25 million in particular have come under increased rating agency pressure. At a time when markets are focusing on performance, these carriers generally saw less favourable outcomes in both price and reduced line size.”

Bob Betz, continued, “More intense competition for cedents with a stronger track record saw risk-adjusted pricing typically fall within a range of flat to down 10% at 1 June 2017. But even here, results were often layer specific, reflecting historical performance, loss activity and terms and conditions.”

The latest rate decrease means pricing for Florida business is now approximately 40% down on 2012 levels and only 10% above the previous cyclical low of 1999/2000. Despite this, and some reinsurers experiencing deteriorating underwriting performances in the first quarter of 2017 due to significant reserve charges following changes to the Ogden discount rate in the UK and a number of global weather-related events (including a series of localised US convective storm events and Cyclone Debbie’s landfall in Australia), excess supply and relatively muted demand at 1 June 2017 prevailed in offsetting these factors.

RETROCESSION

The reinsurance market in Florida is supported heavily by retrocession cover, and pricing levels here were also down at 1 June 2017. An abundance of capacity, along with a lack of significant losses (recent catastrophes such as the Fort McMurray wildfires and Hurricane Matthew had a limited impact on retrocession programmes), meant rates for retrocession placements typically fell by mid-single digit percentages on a risk-adjusted basis.

Demand for retrocession cover remained strong overall as most cedents continued to take advantage of market conditions that are now at their most competitive than at any time since the late 1990s and early 2000s. A number of carriers therefore lowered retentions and added additional layers of coverage at 1 June 2017. Others became more specific in their appetites, moving from worldwide covers to Florida only. A number of reinsurers also moved to buy more occurrence coverage and less aggregate cover during the renewal.

PROSPECTS FOR REMAINDER OF 2017

David Flandro, Global Head of Analytics, JLT Re, said, “Despite elevated loss experiences, reserving volatility, inflationary and interest rate concerns and declining reinsurer returns manifesting so far this year, excess sector capital continues to drive the market. Surplus capacity is enabling cedents to negotiate discounts to expiring reinsurance rates, although renewal outcomes at 1 June 2017 were very much swayed by cedent performance and size.”

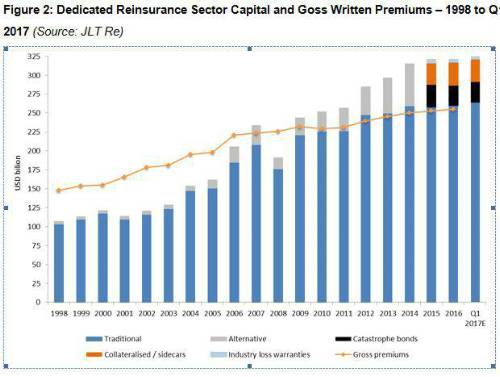

At the end of the first quarter of 2017, JLT Re estimated dedicated reinsurance sector capital once again reached record levels by rising to USD 325 billion from USD 321 billion at year-end 2016 (see Figure 2). Premiums, by contrast, totalled USD 255 billion at the end of 2016. The result is a reinsurance market awash with capacity as supply continues to exceed demand.

Ed Hochberg, Chief Executive Officer, JLT Re in North America, concludes, “While Hurricane Matthew came close last year, no major hurricane has made landfall in Florida or the United States since Wilma in 2005. The return time of an 11-year stretch without a major hurricane landfall across the US coastline is in excess of 300 years, reminding us that such good fortune cannot go on forever. In fact, some forecasts now indicate the 2017 North Atlantic hurricane season could see above average activity. After six consecutive years of falling pricing, reinsurance currently offers an extremely efficient form of capital. Carriers with the foresight to utilise today’s cost effective reinsurance can help secure future profitability by preparing for the next market changing event(s).”

|