The identified risks are relevant to life and non-life insurance areas as well as asset management. They are presented with the goal of helping industry players prepare for new scenarios by adapting their behaviour, market conduct and product portfolios.

The five top risks with the highest potential impact are:

A brave new world? – Emerging geopolitical risk: A new multi-polar world is evolving in the geopolitical landscape as power drifts to Asia, democratic influences decline and the relevance of global governance institutions erodes. Possible turmoil in financial markets and possible erosion of legal rules could threaten the ability to run global businesses.

A slow poison – the erosion of risk diversification: Broad diversification and the free flow of capital are key to run a global re/insurance business. National protectionism and regulatory fragmentation are jeopardizing the benefits of international diversification.

Asbestos reloaded – USD 100 billion in losses and counting: Not all countries have banned asbestos. The UN estimates that one third of the people living in Europe are potentially exposed to asbestos at work or in the environment.

Coming back to bite us – lurking cyber risks: Some flaws and vulnerabilities in hardware and software may remain undetected for a long time. These dormant threats can have a very long tail risk.

Algorithms are only human too – opaque, biased and misled: An increasing number of business processes are driven by algorithms. Often, algorithms are portrayed as being objective, without human bias. But algorithmic applications are not infallible, they base their actions on human judgement as well. Discriminatory bias may also translate into defective modelling and prediction, bringing a two-fold risk to insurance and other industries.

"Our SONAR report is not about forecasting the future or covering all emerging risks, but rather about preparing for its potentialities", says Patrick Raaflaub, Swiss Re's Group Chief Risk Officer. "The more transparency and the more time we have, the better we can adapt to the changing risk landscape", Raaflaub adds.

The report offers insights into emerging risks and highlights a number of emerging trend spotlights. Emerging risks are newly developing or evolving risks that are difficult to quantify, but potentially have a significant impact on the industry and society. Emerging trend spotlights examine early development, which may offer both opportunities and risks for the insurance industry in the future. The report is distributed among clients and the wider stakeholder community in order to inform the debate about emerging risks and facilitate the finding of solutions.

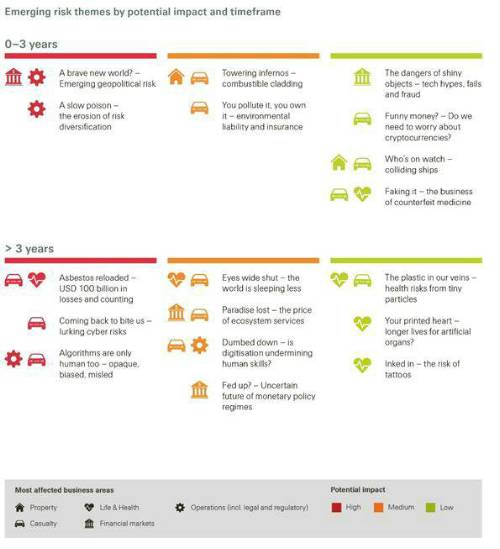

Table: Overview of the 18 new emerging risks and their potential impact over time

|