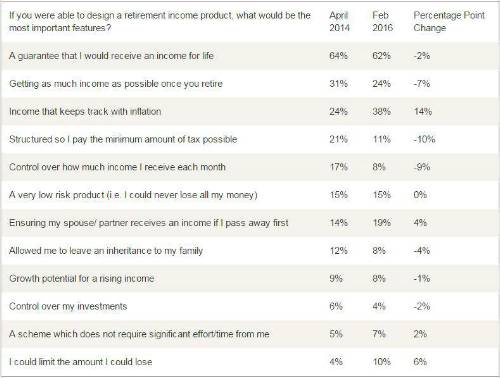

Other important requirements include ensuring that a spouse/partner receives an income should that person pass away (19%), the product being very low risk (15%) and a structure which minimises tax (11%). This research – which was released to highlight the Defaqto guide to Hybrid solutions sponsored by the specialist insurer (Click Here) – has tracked the opinions of almost 3,000 consumer’s age 45 years and over.

With the first tranche of research conducted immediately after the Pension Freedoms announcement (April 2014) and the second tranche conducted ten months after the introduction (February 2016) at a time of stock market turmoil, consumers have shifted their perceptions. Indeed, they have moved from simply maximising income to securing it for the long-term.

People are far less likely to worry about structures to minimise tax (from 21% to 11%), want control over how much income they receive each month (17% to 8%) or are focused on getting as much income as possible once they retire (31% to 24%). Rather they are focused on income which keeps track with inflation (24% to 38%), limiting the amount they can lose (remains 15%) and ensuring their partner/spouse receives an income (14% to 19%).

The Defaqto Guide – ‘The Case for Hybrid: Simplicity, Flexibility and Security’ – looks to help advisers understand the difference between blended and hybrid solutions while understanding more about Partnership’s Enhanced Retirement Account (ERA). The ERA was the first hybrid account launch into the market in October 2015.

Andrew Megson, Managing Director of Retirement at Partnership said:“Despite the advent of the pension freedoms, almost two out of three people still believe that a guaranteed income for life is the most important feature of a retirement income product. Not only that but they are moving away from focusing on simply maximising income and instead looking to secure it for the long term. As the pension freedoms become the ‘new normal’ it will be interesting to see how people’s views change.

“Hybrid products which provide a guaranteed income along with the flexibility of an invested element with the potential for growth would appear to meet many of these customers’ requirements. Therefore, we are delighted to sponsor a Defaqto Guide –– aimed at intermediaries –which looks at how these products work and provides advisers with more tools to discuss this option with their clients.”

Gill Cardy, Insight Consultant from Defaqto, commented:“With the current market turmoil and the far greater range of retirement choices, it is interesting to see that people still favour securing the best guaranteed inflation-linked income. However, while those remain the most popular features, we have seen preferences change as people increasingly seek to benefit from pension freedom and choice by maintaining flexible access to capital and enhanced death benefits for their extended family.

“While advisers have been helping consumers to make sense of the new retirement landscape, they are also working to fully understand its implications. Therefore, we are delighted to offer a CPD guide to hybrid solutions which will help to support intermediaries as they work with their clients to develop sustainable retirement plans.”

|