A heat map developed by Royal London to assess the sustainability of different withdrawal rates over different terms, shows that over a 15 year term a 6% withdrawal rate is highly sustainable. However as the term increases, a 6% withdrawal rate does quickly become unsustainable.

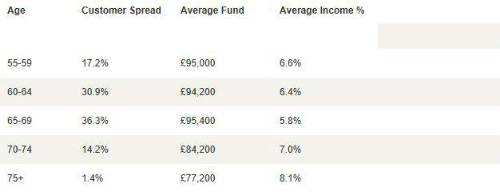

Over two thirds, (67%) of Royal London’s income drawdown customers, are aged between 60 and 69 years of age and the average fund value at the time of the analysis was £94,800. If these customers were to continue to withdraw income at over 6% per annum, 15 years later at age 75 to 84 they could find that their fund is not sufficient to meet their future income needs. They will potentially have to rely on any other savings they have available to fund future income needs such as long term care costs. This is why retirement planning advice is so important and not a ‘one size fits all’ process.

The table shows a breakdown of Royal London customer data as at 31 December 2016:

The analysis also showed that the vast majority of customers (75%) initially took their tax free cash and then started taking a regular income some years later. However, there is a small but increasing number of drawdown customers who are starting to take an income from the outset. At the start of 2016, when the Service was being piloted, 19% of customers were taking an income immediately, and by the end of 2016 this figure had risen to 25%.

Lorna Blyth, Pensions Investment Strategy Manager at Royal London, commented: “The analysis is hugely valuable as it allows the growing number of advisers who use the Drawdown Governance Service to track the behaviour of their income drawdown customers and respond quickly to any changes that may put them at risk.

Identifying any emerging trends is important in the early days of pension freedoms as there remain concerns that people could potentially run out of money. The evidence suggests that, with the benefit of impartial financial advice, this is not likely to happen.”

Lorna continued: “The analysis also shows that the vast majority of customers are taking a fixed rate of income which means they are not making any allowance for inflation. This might be ok while we have low inflation rates but the latest data from the Bank of England* shows inflation is above the government’s target rate and one of the risks that advisers may well need to discuss with their clients at their next review.

“The increase in the number of customers taking income from the outset is interesting and we’ll monitor this to establish whether this is a new trend that is replicated across the industry.”

|