UK residents are unaware of the ways they can protect their homes from flooding and other types of extreme weather, according to new research from Aviva.

A survey of 2,000 UK residents reveals that despite almost half (45%) of people thinking their home is at risk from flooding, less than a third (29%) know what steps they can take to make their home more resilient to a flood.

Concerns about flooding remain high. Over two in five (43%) admit they are concerned about the impact of flooding on their home and 57% of people would consider flood risk when choosing a new home.

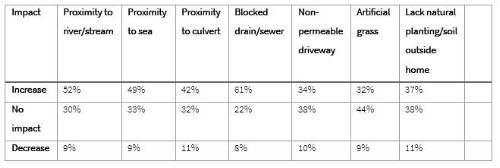

However, many are confused about the risks their property may face, even when homes are close to water. While half (52%) say proximity to a river or stream would increase the risk of flooding, almost a third (30%) believe it would have no impact, and worryingly, 9% think it would decrease the risk. A similar picture is presented regarding proximity to sea.

Less visible risks also cause confusion. Nearly two in five (38%) believe a non-permeable driveway will have no impact on the flood risk to their home, and just under half (44%) think artificial grass poses no risk. However, with almost a quarter (23%) of homes in the UK at risk from flooding – with surface water flooding posing the biggest risk - a lack of drainage caused by artificial grass or paved driveways can make matters worse.

Table: Which of the following, if any, do you think could increase or decrease the risk of flooding at your property?

Making homes climate-ready with flood resilience

The research also reveals that although consideration for flood resilience is high, this doesn’t translate into action. The majority of people (85%) agree it is important to build homes that are resilient to flooding and 73% say they would look for resilience measures if they were looking for a new home.

However, awareness and installation of these measures remains low, with less than a third (29%) knowing what steps to take to protect their home. And less than half (48%) of residents say they have implemented flood resilience measures. But there are signs that take-up is slowly increasing. In a similar survey last year3, only 33% had taken any steps to improve resilience in their home, showing that some progress is being made.

Hannah Davidson, senior home insurance underwriter at Aviva, said: “Our weather patterns are becoming increasingly unpredictable yet many people are unaware of the risks to their home. It’s worrying that even physical signs of water, including rivers or proximity to sea, aren’t a warning to some residents that flooding could pose a risk to their home. Many will hope that flooding won’t happen to them, but the reality is that floods can and do happen anywhere, so we should all be prepared.

“Taking steps to make homes climate-ready doesn’t have to be expensive or intrusive. Simple measures, such as placing appliances on plinths or moving valuables to higher shelves can help if flood water enters the home. Other measures, including replacing plaster and floorings with more waterproof equivalents, can make the clean up quicker.

“But it’s also important for people to consider flood risk when making changes to their outside space. Replacing gardens with paved driveways or artificial grass may seem like low-maintenance options, but the lack of drainage can increase the risk of flash flooding in heavy downpours. Even a few centimetres of water can cause a lot of damage and may mean residents need to move out of their home.”

The survey also reveals that wider concerns about climate change among UK adults have dropped since last year. Almost two in five (38%) of adults believe climate change will impact their home in the next year, compared to 45% who said this in 20223.

Concerns about the longer term have also decreased, with 50% saying they believe climate change will impact their home in the next five years and 58% in ten years, compared to 59% and 65% respectively last year. The fall in concern this year could relate to fewer extreme weather events in 2023 compared to 2022, which saw heatwaves, flash floods and wildfires. Other issues, including cost of living pressures, could also be impacting climate concerns.

Of those who believe climate change will impact their home within a decade, heat remains the biggest worry, with 57% of people citing this as a concern. This is followed by storms (48%) and flooding (33%).

Davidson adds: “Being prepared and aware of flood and climate change risks can make a real difference, helping to lessen the emotional and financial impacts that floods can bring. Some insurers, including Aviva, are participating in Flood Re’s Build Back Better4 scheme which helps people whose homes have suffered significant flood damage to access property flood resilience during the repair process. Making homes climate-ready by installing resilience measures can reduce the risk of water entering the home and help to limit the impacts of any future flood.”

Aviva has the following tips to protect homes against flooding:

• Check your risk. You can find out the flood risk of your property using the Government’s flood risk checker.

• Store important or sentimental items high up – either on a higher floor or on shelves.

• Add non-return valves to toilets in your home, so water can only go one way.

• If you’re considering changing your garden or driveway consider porous materials like gravel, or real grass which will help water to be absorbed underground.

• Sign up to receive the Environment Agency’s floodline warnings, and follow the Met Office on social media, for real-time alerts about upcoming storms.

• Make sure your insurance is water-tight. Check your home insurance policy to see what you’re covered for in the event of a flood. It’s also worth checking your insurer is signed up to the Flood Re scheme, which aims to improve the accessibility and affordability of flood cover.

Aviva has developed an extreme weather customer hub which provides advice and tips on flood risk, how to stop water getting in, and what to do if your home is flooded.

|