Over a quarter of retirees aged over 55 were forced into retirement because of ill-health, redundancy or to provide care for a family member, according to research carried out by retirement specialist Just Group for its Countdown to Retirement series.

The survey of over 1,000 retired and semi-retired people aged 55+ found that nearly half (45%) retired earlier than they had expected.

Of those people, the majority said they were driven out of the workforce due to factors beyond their control rather than choosing to retire for more positive reasons.

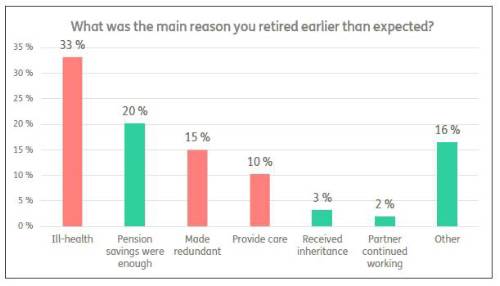

A third (33%) said that they retired earlier than expected because of ill-health or physical impairment. A further 15% were either made redundant or could not find a job while one in 10 (10%) said they retired earlier than expected to provide care for a family member.

It means 26% of retirees over the age of 55 had been forced out of the workforce.

Stephen Lowe, group communications director at retirement specialist Just Group, said the figures highlight the value of financial planning for workers starting the transition towards retirement.

“This new research is evidence of the impact unexpected events can have on people’s later lives,” he said. “For over a quarter of retirees early retirement is more of an unwelcome drama than a dream as they are forced out of employment due to events beyond their control.”

“People cannot bank on being able to choose the exact point when they retire and in those circumstances a back-up plan becomes extremely valuable. It is worrying that so many people are dropping out of the labour market without knowing whether their pensions and savings will be sufficient.”

Just one in five (20%) of those retiring earlier than expected said it was because their pension savings were large enough to support them through later-life.

Having to retire earlier than expected can cause significant financial difficulties as people must bridge the gap before the State Pension kicks in. Dipping into pension savings often seems like the solution, but doing so reduces the amount people have to rely on in later-life. It can also limit their ability to build up their pension should they manage to return to employment.

Meanwhile, economic inactivity because of chronic health conditions among 50–64-year-olds has soared since the pandemic.

“Life’s busy and people have competing demands for their attention but taking a bit of time to work out your ‘what if’ plan will be well worth it should life take an unexpected turn,” said Stephen Lowe.

“A great place to start is Pension Wise. It offers free, impartial, independent and government- backed guidance designed to help over 50s understand their pension options.”

|