Cash-strapped pensioner homeowners are missing out on thousands of pounds of extra income by failing to claim their full entitlement to key means-tested State Benefits.

Just Group’s 14th annual State Benefits insight report found that eight in 10 (79%) pensioner homeowners eligible to claim benefits were failing to claim anything at all with each household missing out on an average of £1,231 a year extra income.

One in 10 (9%) were claiming but receiving too little, on average missing out on an additional £476 income per year.

“Every year our research identifies benefits of a very significant value are not being claimed but would make a massive difference to those struggling with soaring living costs,” said Stephen Lowe, group director at the retirement specialist Just Group.

“This year the proportion who are eligible for benefits but failing to claim is at its highest since 2014, while the money they are missing out on is the second largest amount in that 10-year period.

“Nearly four in 10 households in our survey are eligible for one of the key benefits available to pensioners, but the majority are not claiming and even those who are often don’t apply for their full entitlement. Missing out on Pension Credit is particularly problematic because it is the gateway to a host of other benefits such as free NHS dental care, cold weather payments and a free TV licence for over-75s.”

The research from Just Group, is based on in-depth fact-finding interviews with clients seeking advice on equity release during 2023. It shows 38% were entitled to benefits. Of those eligible, nearly eight in 10 (79%) were not claiming at all and one in 10 (9%) were claiming less than they were entitled to.

“One of the first steps carried out by specialist equity release advisers from our sister company HUB Financial Solutions is to check if clients are eligible for State Benefits income,” said Stephen Lowe.

“Ensuring people claim their full benefits entitlement often provides much of the extra income they need, reducing or removing the need to release any funds from their property at that time.”

The highest amount of extra income uncovered was £143.43 a week for a pensioner couple living in Surrey who were receiving no benefits. Advisers found they were eligible for £111.30 a week Pension Credit and £32.13 a week Council Tax Reduction – adding up to a huge £7,458 a year extra income.

In total, a quarter (27%) of those missing out on income were entitled to benefits worth at least £1,000 a year.

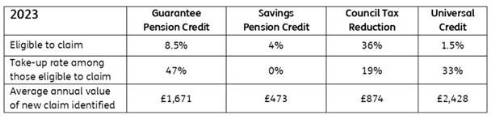

Guarantee Pension Credit is the main benefit targeted at helping low-income pensioners. It has the highest take up rate of all the four key benefits but was claimed by less than half (47%) who could receive it. Those failing to claim were missing out on an average £1,671 extra income per year.

Savings Pension Credit is a top-up for pensioners on low income who have modest savings. It has the lowest proportion eligible (4%) but also consistently the lowest take-up rate. In 2023 (as in 2022) none of those eligible were claiming it, missing out on an average £473 income a year.

Council Tax Reduction is the benefit with the highest eligibility but only about one in five (19%) of those entitled were claiming, missing out on an average £874 each.

Universal Credit is available to those below the State Pension Age. About a quarter of Just Group’s lifetime mortgage enquiries came from households below State Pension Age meaning they are potentially eligible for Universal Credit. Although actual eligibility rates were low, the take-up rate was just 33% with households missing out on a significant £2,428 a year income on average.

Overall, 64% of those eligible to claim were missing just one of the key pensioner benefits, 13% were missing out on two benefits and 4% on three benefits.

Government estimates suggest take-up of Guarantee Pension Credit was 70% and Savings Credit 39% in 2021/22. Overall, 880,000 pensioner families entitled to receive Pension Credit did not claim, totalling about £2.1 billion or around £2,200 a year for each family on average.

“Our take-up figures for homeowners are a little lower than those published by the government, suggesting some people who may think owning a home rules them out of receiving State support,” said Stephen Lowe.

“Research by Just Group’s sister company HUB Financial Solutions3 found more than a third of over- 65 homeowners (36%) have never checked their entitlement to State Benefits with a further 14% unsure or unable to remember when they last checked.”

He said the findings once again raise questions about the support and guidance available to people heading into retirement and beyond.

“Benefits information is integral to retirement guidance and should make clear the range of benefits available to help people who find themselves struggling for income or in poor health later in life.”There are a range of resources to provide information and guidance:

• The government highlights free, independent third-party benefit calculators at https://www.gov.uk/benefits-calculators

• Local councils provide information on financial help to pay rent or Council Tax

• Organisations such as the MoneyHelper and charities such as Citizens Advice and Age UK can be good sources of assistance.

• Free, impartial and independent guidance is available to retirees through the government- backed Pension Wise.

• Professional advisers will charge but can provide regulated advice alongside information about benefit eligibility.

|