Retirees are being encouraged not to accept the first offer when seeking to use pension money to buy Guaranteed Income for Life but to shop around for ‘personalised’ rates that take their health and lifestyle into account.

Retirement specialist Just Group warned that accepting your own pension provider’s offer rather than actively seeking the best rate available to you is like being taxed extra by your provider for assuming they are offering a competitive deal.

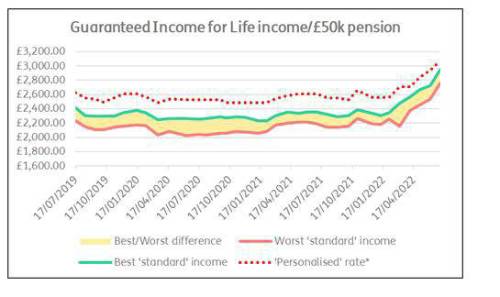

“The difference between the best and worst providers can be up to 15% a year extra income and the two-thirds of retirees likely to be eligible for extra due to medical conditions or lifestyle factors could enhance that further,” said Stephen Lowe, group communications director at Just Group.

“Not shopping around for that extra income – cash that will be paid every month for as long as you live – is like accepting a ‘torpor tax’ that should enrage people who are losing out.”

He said analysis shows that in the last two years the difference between the best and worst rates was up to 15% at times. On a £50,000 pension that would be £206 a month income instead of £180, equal to

£7,800 extra income over 25 years.

Historical rates show the gap (yellow shading) between the best and the worst rates available to a 65- year-old. The red dots are a guide to the extra income available based on an average of enhanced rates for those eligible taking into account a range of factors and conditions.

“Guaranteed Income for Life rates have been rising in recent months but what this chart really shows is the danger that by not shopping around, retirees will end up with less income from accepting rates in the yellow shaded area, somewhere between the best and worst standard rates,” said Stephen Lowe.

“By shopping around – using a professional adviser or broker who takes the retiree’s health and lifestyle into account – they should at least receive the best standard rate and our figures suggest two-thirds will get a rate around the red dotted line.”

He said that small differences can add up to large sums over the 20-30 years of the average retirement and that fully disclosing your medical history and any medication you are receiving plus personal information such as height, weight and alcohol consumption can make a big difference.

“The age that is important when considering your income is your biological age rather than your calendar age,” said Stephen Lowe.

“By understanding your personal situation rather than assuming you are in good health, pricing can more fairly reflect your situation.”

He said that anyone considering tapping into their private pension money and keen to avoid pitfalls such as paying extra tax or falling victim to scams can get free, impartial and independent guidance from the government-backed Pension Wise service.

“These are complex decisions that may tie you in for the rest of your life, so it is important not to just take the easiest route to get at your money quickly but to make an informed decision you will not regret later.”

|