By Fiona Tait, Technical Director, Intelligent pensions

According to the report, nearly 50% of people will fail to achieve a personally acceptable level of income in retirement, and fewer than 1 in 10 can expect to be ‘comfortable’. This is not a situation that can be allowed to continue.

The problem is most people have no idea:

a. How much they will need to support themselves in retirement, and

b. How much they need to save to provide this

What is adequate?

The report begins by considering the first question. Unsurprisingly, different people want different things, and different groups also have different objectives.

The government wants to keep people out of poverty and avoid their having to fall back on the State for support. It makes sense therefore that they focus on finite measurements as exemplified by the Joseph Rowntree Foundation’s ‘basket of goods’ approach.

By this measure the Minimum Income Standard (MIS) is £10,712 for a single retiree and £16,536 for a couple, which is just about covered by the new State Pension (assuming full entitlement). Focussing on this measure allows the government to work to their objective of covering basic needs without burdening the taxpayer with the additional cost of helping those who are better off to stay that way.

Individual savers are more likely to be interested in maintaining their own lifestyle and hence a ‘replacement income’ approach would be more useful. The Pensions and Lifetime Savings Association (PLSA) believes that most people would want more than just the minimum income and have developed their Retirement Living Standards. These Standards estimate that a ‘moderate’ standard of living in retirement may be provided by an annual income of £29,100 for a couple living outside of London but a ‘comfortable’ retirement would require £47,500 p.a.

These figures provide a very helpful target but there are two further things to bear in mind:

1. The figures assume that income needs are likely to remain stable during retirement and PPI modelling suggests that this is not the case, with spending generally decreasing over time.

2. The figures do not take into account unexpected costs such as replacing household items or coping with illness or divorce.

Therefore the amounts needed should ideally be supplemented by ‘rainy day’ money and considered over a period of time, which is why cashflow modelling is so useful.

How much is needed to provide adequacy?

The Retirement Living Standards provide non-pensions people with a realistic and objective target for their savings, but that is only half of the job. The second question is how much is needed to provide those income levels for as long as they are required. This is the real kicker for those who have never considered their pension beyond not opting out of the workplace scheme or, worse, actually think that 8% of band earnings is sufficient.

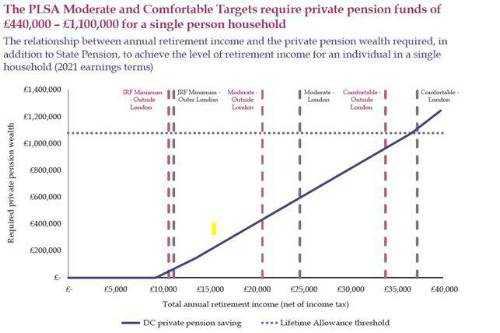

PPI modelling suggests that a ‘moderate’ income, of £20,700 for a single person, requires a retirement fund of at least £440,000 at age 67. A ‘comfortable’ income of £37,300 requires a fund of over £1m.

Is this the most important chart in pensions planning?

In a defined benefit (DB) dominated world, savers do not need to worry about this part of the equation however, as we become more reliant on defined contribution (DC) savings it becomes crucial, and most people are unaware of that.

It is therefore vital that government, the pensions industry and ideally employers, do everything they can to communicate it. Tools are available but the report found that very few people use them.

How bad is the problem?

It’s bad. According to the report only 10%C of DC savers are on course to preserve their living standards in retirement. Despite automatic enrolment we haven’t moved far from the Pensions Commissions original 4 choices.

Unless something changes people will need to:

• Save more than 8% of band or even total earnings

• Work longer, at least until State Pension Age

• Be given higher State Pensions at the likely cost of additional taxes

• Accept a less affluent retirement

As things stand savers are unwittingly opting for the fourth choice, we need to help them to understand the first choice.

|