Retiring in the Red: Initial findings from this work suggest that the “Retirement Class of 2020” faces significant debt challenges with more than one in three people retiring in the red with average debts of £17,460. Of those in debt, 48% still owe money on credit cards, 31% have an outstanding bank loan and 14% will still have a mortgage. While the average amount owed by those in debt is £17,460, 8% owe over £20,000 and 4% do not actually know how much they owe.

Clearing debts will be a drag on their retirement finances – on average they expect to take around three-and-a-half years into retirement to be debt-free. However, one in eight of those in debt expect to owe money for nine years or more with a third of them saying they will never pay off the money they owe.

Retirement Conversations: While some of those who are retiring with debt undoubtedly do so due to last minute unplanned expenses, 34% of people only start to make definite plans to retire within twelve months of their intended finish date – a relatively short period in which to clear borrowing. Even those who take the average two-years-and-four months to plan the end of their working lives might find it a challenge if they owe just over £17,000.

Over-65s have more than 1 trillion pounds worth of unmortgaged housing equity and Key is launching a major new marketing campaign to encourage people to get answers to questions they may have around equity release. The campaign which will run across TV, press, digital and social will look to inform and educate older consumers to ensure that unanswered questions are not the reason that they are failing to consider all their options and therefore risk continuing to struggle with challenges like debt repayment in retirement when solutions such as equity release may be available.

Will Hale, CEO at Key, said: “With changes to the state pension due to start coming into effect this year, it is vitally important to understand the challenges and aspirations of the “retirement class of 2020”. Today’s findings suggest that while most people work hard to retire debt-free, this is not the reality for one in three people who need to consider how they can service and repay over £17,000 in borrowing from their retirement nest egg. Even those with generous incomes may find this a stretch and people are taking an average of three-and-a-half years to clear the debts they retired with – at a time when they should be enjoying an active retirement and worrying less.

“Equity release is not right for everyone but it is vitally important that people are not prevented from considering how their largest asset, their home, can support them in retirement by misconceptions and unanswered questions concerning later life lending options. There is a lot of help available online on how to budget for retirement and working with a financial adviser in the run-up to retirement can make a massive difference in being as retirement ready as possible.”

Around the country

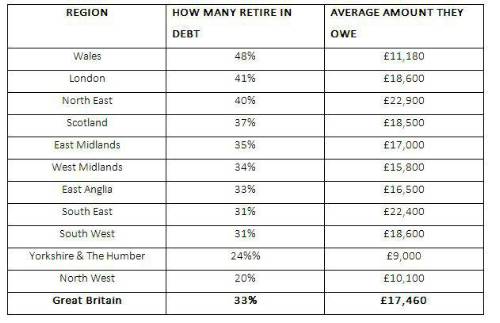

People expecting to retire in Wales are the most likely to have debts – nearly half (48%) expect to retire in the red but the average amount they owe is among the lowest in Great Britain at £11,180.

The biggest average debts are owed in the North East at £22,900 and in the South East at £22,400 with people retiring in Yorkshire & The Humber owing the least on average at £9,000 while those in the North West also have lower than average debts at £10,100.

|