Generation Y, those aged between 18 and 31, will have it the worst when it comes to funding their retirement, according to a third (33%) of Brits surveyed by NOW: Pensions. Two thirds (65%) predict the baby-boom generation, those aged between 51 and 71, may be the last able to retire with sufficient savings. Nearly a third (29%) believe those born today will struggle the most.

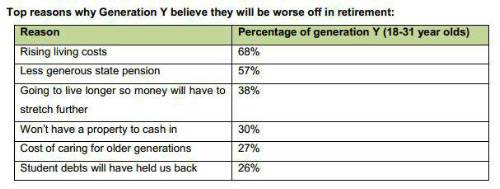

According to a study conducted by the workplace pensions provider, over half (51%) of Generation Y expect to be worse off than their parents in retirement, with the majority (68%) blaming rising living costs and a less generous state pension (57%). Over a third (38%) think increased longevity will put a strain on their retirement income while 30% say they don’t anticipate being able to cash in on property to fund their retirement. Over a quarter believe that the burden of student debt will hold them back.

Yet despite this, Generation Y appear unconcerned about their long term financial future, with only 37% saying they are worried about funding their retirement, compared to almost half (45%) of babyboomers. This sentiment is clearly reflected in their savings habits, with almost half (46%) currently failing to save on a regular basis.

When it comes to how Generation Y expects to fund the shortfall in their retirement savings, over half (56%) plan to save or invest more, 55% will work longer, 31% intend to increase pension contributions while 30% anticipate working part time in retirement.

Morten Nilsson, CEO of NOW: Pensions said: “Sky high rents, the rising cost of living and stagnant wages have all made saving for the future near mission impossible for Generation Y.

“But, with final salary pension schemes relegated to the history books and state pension provision just £110 per week, saving for retirement has never been more important.

“Automatic enrolment into workplace pensions will help those that are struggling to save, get into the savings habit but it’s important that employers and pension providers drive home the importance of staying in the scheme.”

|