Age 36 marks a turning point at which we start to look to the future and begin actively planning for our retirement according to new research from Standard Life’s forthcoming Retirement Voice report. After more than a decade in the workforce and with major milestones often behind us, the research finds we have both the capacity and willingness to begin saving more actively at this point.

Before 36, just 23% of people pay more than the minimum auto-enrolment contributions of 8% of earnings into their pension. However, by 36 the research among 6,000 people found that this figure jumps more than 50% to 35%.

All grown up by 36?

There’s strong evidence to suggest that by our mid-thirties we’re more settled in life and official statistics show the average age for both marriage and home ownership today is 34. Our capacity to save is greater and Standard Life’s research found that the average age people said they felt more financially comfortable was 37. It is also a time when people start to become more confident in their ability to make financial decisions with 63% of 36 year olds confident in their abilities compared to an average of 56% for younger groups.

Prospect of 30 more years of work a possible prompt for retirement planning

While nearly two fifths (39%) of over 30s felt positive about their career prospects, compared to just 18% who felt negative, 36-year-olds today face another 32 years before they will be eligible for the state pension and this figure could rise further.

When asked how they felt about the prospect of another three decades of work, a fifth (20%) of those in their thirties said ‘depressed’, while 14% felt ‘tired’ and 11% ‘stressed’ and it’s possible the planning urge is also a response to a desire for greater financial freedom.

Gail Izat, Managing Director for Workplace at Standard Life, part of Phoenix Group commented: “Many people find the age of responsibility really begins when they reach their mid-thirties, as they often start to buy property or consider starting a family. With responsibility comes more of a need for financial security now and in the future, and so this tends to be the age people tend to start thinking about their long-term as well as day-to-day financial goals. The recent pressures of the cost-of-living crisis, high housing costs and other challenges like tuition fee repayments mean people starting to save now face considerable trade-offs when it comes to deciding what to prioritise financially, and so it’s more important than ever that employers and pension providers help people to engage with their long-term savings. Pension saving is vital, but it should be viewed in the context of people’s broader financial priorities – for employers and pension providers, taking a holistic approach to people’s financial wellbeing is vital to securing the best possible long-term outcomes.”

Starting sooner than today’s retirees – but is it soon enough?

When it comes to retirement planning, people today are giving themselves a 13-year head start on current retirees, who began their planning aged 49 on average. This is a positive sign, particularly as the majority of today’s retirees express regrets about how they approached planning:

• 55% wish they’d thought about retirement finances at a younger age when they’d had more time to make changes

• 54% wish they’d saved more for their retirement

• 53% wish they’d started saving for retirement earlier

However, with the shift from defined benefit pensions which offer a guaranteed level of retirement income, to defined contribution which do not, the onus is firmly on younger workers to take responsibility for their retirement plans.

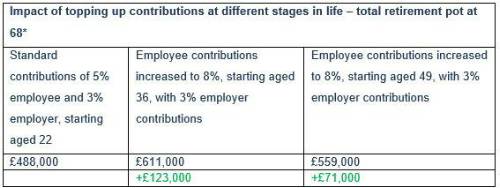

A 3% increase to employee contributions at 36 could add £120,000 to eventual pension pot

Increasing pension saving in your thirties could give your pension pot a healthy boost at retirement age. For example, someone that began working full-time with a salary of £25,000 per year and paid the current standard monthly auto-enrolment contributions (5% employee, 3% employer) from the age of 22, could amass a total retirement fund of £488,000 at the age of 68, not taking inflation into account. However, topping up contributions by 3% from the age of 36 could give you £611,000 by the age of 68 – £123,000 more than if no tops up were made. If the 3% top up was made from the age of 49, this could result in £559,000 at the age of 68.

*if beginning working with a salary of £25,000 per year and paying 3% employer, 5% employee monthly contributions into a workplace pension and assuming 5.0% investment growth and 3.5% salary growth per year. Figures are not reduced to take effect of inflation. Annual Management Charge of 1% assumed. The figures are an illustration and are not guaranteed. Earning limits not applied.

Gail Izat continues: “Unless they’ve spent most of their careers in the public sector, future retirees will be very unlikely to have Defined Benefit pensions, which offer a guaranteed payment in retirement. Instead, the amount people have in their pots will depend on how much they and their employers pay in throughout their careers, as well as investment returns. Any saving is better than none, but saving at the current minimum contribution rate is unlikely to be enough for an enjoyable standard of living in retirement by itself.

“It can be incredibly hard for people in their twenties and early thirties to prioritise saving for the future, as their main focus is often just getting a financial foothold in an increasingly expensive world. The good news is if people are able to pay in a bit more from their mid-thirties, when life’s hopefully settled down a bit, there’s still time to see a real boost by retirement. Offering engaging financial education tools and tailored content throughout people’s careers are two of the best ways employers and providers can ensure people maximise their opportunities to save for the future. Nobody’s life is straightforward and making sure products, communications and customer experience are capable of being adjusted to suit people’s individual circumstances at any age, particularly if and when they experience vulnerability, is also key. There’s no doubt that saving a bit more when they can is one of the best gifts a person can give their future self.”

|