-

Almost two in three (62%) of today’s retirees feel their experience of retirement is better than expected

-

Retirees also report greater contentment with their finances, health, diet, exercise and time spent with family

-

Planning ahead almost doubles the percentage who enjoy a retirement free from financial worries

-

Yet half of adults in their 40s and 50s have not started to plan for retirement – including 27% who say they are near to retiring

-

73% of today’s retirees had no plans to work during retirement; just 45% of the unretired say the same

-

62% of retirees describe themselves as happy, and they are twice as likely as unretired people (14% vs. 7%) to be extremely happy

The Aviva study examines the life experiences and aspirations of over 6,000 UK adults in six areas that contribute to their overall happiness and wellbeing: finances, relationships, health, working life, leisure time, and vision (life ambitions and future planning).

The findings reveal how expectations of retirement are changing with almost two in three (62%) of today’s retirees feeling retirement is better than they imagined, including three in ten (29%) who feel it is much better.

Almost two in three (62%) retirees describe themselves as happy, compared with just 42% of those who are not yet retired. Retirees are also twice as likely as unretired people to be extremely happy (14% vs. 7%).

Comparing people’s outlook before and after retirement, Aviva’s study also reveals:

-

Retirees are more than twice as likely to feel in complete control of their lives and decisions (39% vs. 17%)

-

Retirees are significantly more likely to feel fulfilled in life (63% vs. 40%)

-

Retirees are almost twice as likely to feel happy with their finances (55% vs. 30%)

-

Retirees are more content with their general health (53% vs. 50%), diet (66% vs. 48%) and sleep (53% vs. 39%)

-

Retirees are happier with the amount of exercise they get (45% vs. 39%), time spent on leisure pursuits (73% vs. 42%) and more likely to feel physically well (57% vs. 51%)

-

Retirees are more content with the time spent together in person with family (75% vs. 62%), friends (73% vs. 53%) and on their own (77% vs. 68%)

-

Among those who still do paid or unpaid work, retirees are more content (78% vs. 44%) and fulfilled (78% vs. 47%) than unretired people with the work they do.*

Planning is key to a retirement that exceeds expectations

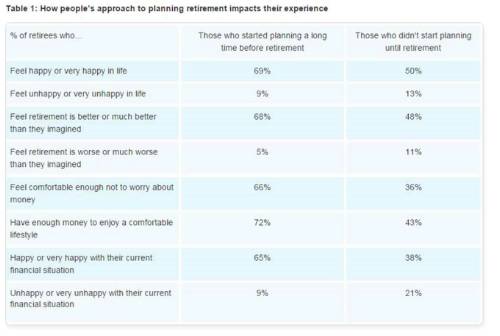

Aviva’s analysis also demonstrates a clear link between people’s approach to planning and the probabilities of experiencing a happy retirement that exceeds expectations.

Being comfortable enough not to worry about money is by far the most important financial objective for retirement, shared by almost three in four (74%) adults over the age of 30.

However, barely one in three (36%) retirees who left their planning until they retired have achieved this goal, compared to 66% who started planning a long time ahead.

Among those who planned well in advance, 69% feel happy or very happy; 68% feel their retirement exceeds expectations; 72% have enough money to enjoy a comfortable lifestyle; and 65% are happy with their financial situation.

The picture is significantly gloomier for those retirees who did not start planning until they retired. They are twice as likely to feel retirement is worse than they expected (11% vs. 5%) and more than twice as likely to be unhappy with their financial situation (21% vs. 9%).

Major planning gap leaves future retirement ambitions in doubt

Aviva’s research indicates seven in ten (71%) of today’s retirees started planning their retirement in advance, including 48% who started planning a long time before they retired.

However, despite the clear benefits they have enjoyed, it also shows many people continue to leave their retirement experience to chance by neglecting to take any action to prepare.

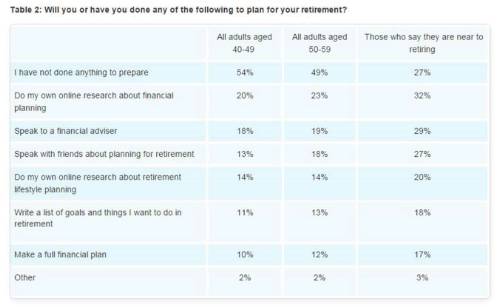

Almost half (49%) of adults in their fifties say they have not done anything to start planning for their retirement, rising to 54% among people in their forties.

Even among those who are nearing retirement, more than one in four (27%) say they have not done anything to prepare, either by taking matters into their own hands or seeking support from friends or a financial adviser.

Just 32% of people approaching retirement have done their own financial planning research online or plan to do so; fewer still (29%) have spoken to a financial adviser or plan to do so; and just 17% have made a full financial plan or will do so before they retire.

Fewer than half of future retirees plan to leave work behind them

Comparing generational attitudes to retirement, Aviva’s research highlights a number of differences including a major shift in approaches to work following the end of compulsory retirement in the UK. While 73% of today’s retirees had no plans to do paid or unpaid work once they retired, just 45% of people who are not yet retired can say the same.

Among retirees who still do paid or unpaid work, only 23% feel money is a primary motive, making it less important for them than feeling satisfied or fulfilled (48%), having new challenges or experiences (41%) or having a sense of importance or role to play (34%). More than four in five (81%) find the work they do in retirement to be equally or more fulfilling than the work they did before they ‘retired’.

However, among people who are yet to retire and plan to work during their retirement, money is by far the most common driver with 65% expecting to work for this reason.

Rodney Prezeau, Managing Director, Consumer Platform, Aviva UK Life, said:“These findings are inspiring and alarming in equal measure. On the one hand, it is reassuring to see the ideal of a happy retirement exists, and that many of today’s retirees find the experience exceeds their expectations. Growing older brings many challenges which mean happiness is far from a universal experience, but this shows that planning ahead can greatly improve your chances of finding fulfilment. It sounds obvious, but just by saving smarter you could be working towards a happier retirement.

“At the same time, the relative happiness of current retirees begs the question: is this a golden generation, unlikely to be seen again? It may be no surprise that many people leave their retirement planning to chance, but it is a growing concern when you consider that final salary pensions are on the path to extinction, the Default Retirement Age has expired, and high rates of home ownership and house price growth are far from guaranteed in future.

“Planning ahead and taking matters into your own hands is becoming ever more important to increase your chances of achieving a comfortable retirement. Aviva is committed to helping Britain save smarter and support people to ask the right questions and think ahead as far as possible to reach their retirement goals.”

|