A fifth of over 50s expect to, or are relying, on secure income sources such as a DB pension when it comes to funding their retirement, according to Standard Life, part of Phoenix Group’s annual Retirement Income Almanac[1]. However, the most common source of income, cited by three quarters (73%) of over 50s, was the state pension, highlighting its central role in most people’s retirement plans.

Numbers expected to rely on DB declining

The Retirement Income Almanac, which tracks the different sources of retirement income for over 50s, confirms how the number of people with access to DB pensions will drop off over the coming years. The results showed that 27% of over 80s and 23% among over 70s said they rely or intend to rely on it, compared to 20% of over 60s and 15% of over 50s.

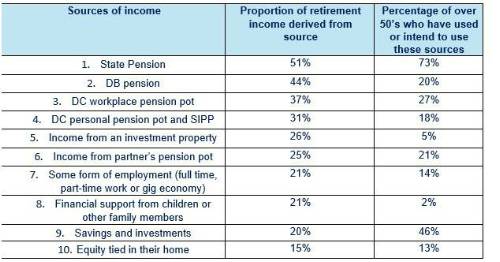

Top sources of income over 50’s have used or intend to use to fund their retirement, and the proportion of income from those sources

The findings also point to the value of these generous pension arrangements, with over 80s saying 56% of their income comes from DB pensions, while the figure for over 60s and 70s was 46% and 45% respectively.

The Retirement Income Almanac also shows how around one half of over 50s (46%) have used, or intend to use, general savings and investments to help fund their retirement, contributing an average of 20% to their overall income in retirement. Other sources of income include DC workplace pension pots which have or will make up 37% of retirement income for around one third of over 50s (27%). A further fifth of over 50’s (21%) have or expect to have the income from a partner’s pension pot, making up 25% of their overall income in retirement.

Furthermore, over one in ten (13%) of over 50’s use, or intend to use, the income tied up in their home to fund their retirements, making up 15% of their overall retirement income. While 5% have or intend to use income from an investment property, making up a sizeable 26% of their retirement income.

The research also reveals that a small number are also turning to children or family members for financial support in retirement. While this only makes up 2% of over 50’s, the proportion of retirement income derived from this source is a sizeable 21%.

Claire Altman, Managing Director of Individual Retirement at Standard Life, commented: “Pension planning grows increasingly complex for retirees as we continue to move away from the era of guaranteed DB pensions, with people increasingly reliant on more varied sources of income. This data also highlights the reliance on the State Pension and the inherent challenges around potential changes to the State Pension age. Almost three quarters of over 50’s say it makes up, or will make up, around half of their income in retirement.

“For those approaching or at retirement, the focus will be on how to access their savings and make them work harder. Most people will want a degree of guaranteed income to cover essential spending but the reality is almost a third (31%) of over 50s say they are unsure or don’t know how to use or plan to use their savings. This makes it all the more imperative to make sure we, as an industry, are helping people make the best decisions around how to manage their retirement income.”

|